Jennifer Anderson, Co-Head of Sustainable Investment & ESG at Lazard Asset Management, speaks to LUX Contributing Editor, Samantha Welsh, about the history of her career, the changes in the ESG investment landscape over that time, and offers an insight into why she thinks the industry is at an important inflection point

Jennifer Anderson, Co-Head of Sustainable Investment & ESG at Lazard Asset Management, speaks to LUX Contributing Editor, Samantha Welsh, about the history of her career, the changes in the ESG investment landscape over that time, and offers an insight into why she thinks the industry is at an important inflection point

LUX: What inspired you to pursue a career in sustainable investing?

Jennifer Anderson: My grandmother was a visionary, in my eyes. She was an early campaigner with Greenpeace in the 70s and 80s and often spoke about her work. I remember her talking about her involvement with the Chernobyl Children’s Project, activities to protect the ozone layer and cleaning up local beaches. That certainly sparked my passion for environmental issues. As I continued my education, I sought study options that helped me explore the intersection between business and the environment. At university, I studied environmental economics and development economics. The lightbulb moment was during my work experience with an asset manager, where I first learnt about socially responsible investing (SRI). I remember thinking “Wow, you can have a career in investment focused on understanding how social and environmental issues relate to that”.

Follow LUX on Instagram: luxthemagazine

My career continued in asset management in the then ‘niche’ area of SRI, with focus on an ecology fund that was the first authorised green unit trust launched in the UK. I then joined an ESG Equity Research team on the sell side, authoring research on BP’s Macondo disaster. I built on this experience at an asset owner, where I spearheaded ESG and climate integration for pension funds. Since 2019 I have focused on the expansion of sustainable investment and ESG integration at Lazard Asset Management.

Jennifer Anderson, Co-Head of Sustainable Investment & ESG at Lazard Asset Management

LUX: There has been a bit of an ESG backlash recently. Is this the beginning of the end for ESG?

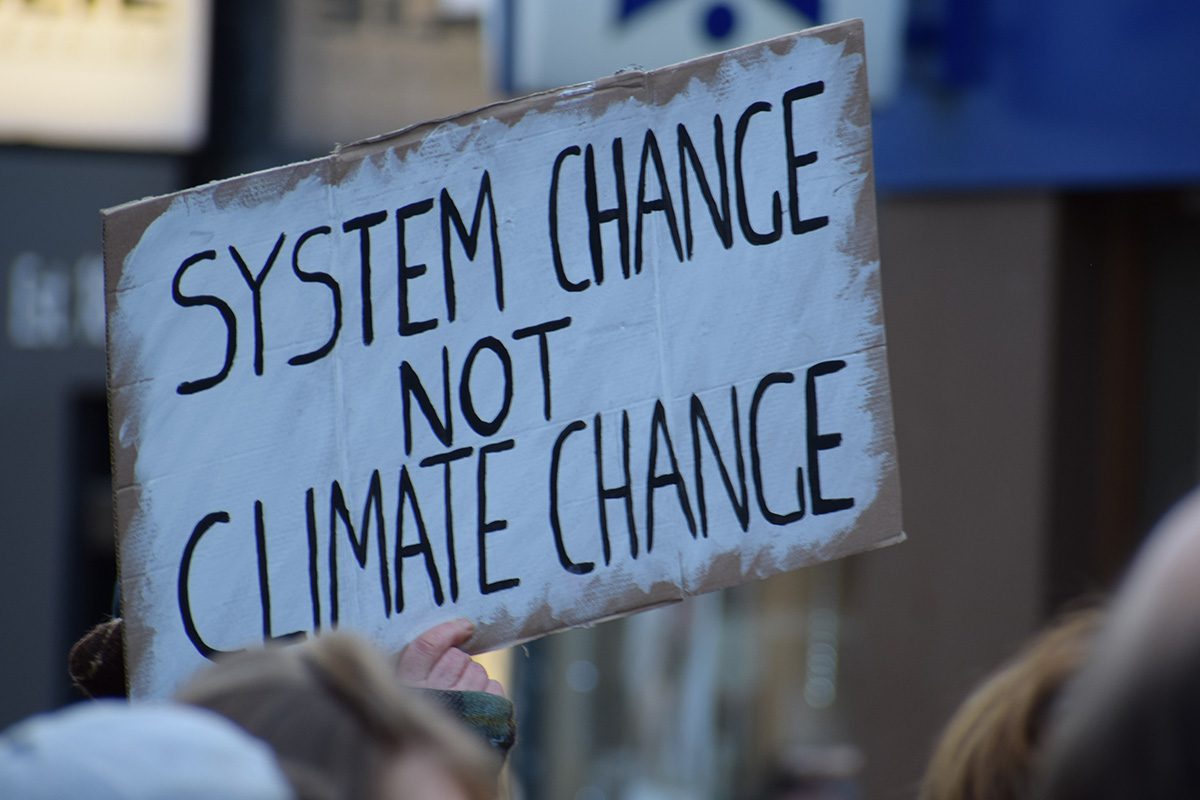

JA: Far from it. In some ways the public’s growing scepticism was to be expected, and so one could argue the industry needed to go through this, have healthy debate, and adjust approaches to arrive at a better place. The frequency and severity of extreme weather events is increasing, and income inequality continues to widen. The momentum to correct these imbalances is building, but to many it remains slow. So, it is easy to understand the growing ire. There is also a great deal of noise that investors must cut through in this growing space. News headlines about greenwashing create doubt, the current “one size fits all” corporate scoring approaches create confusion. Recently, the S&P 500 ESG Index dropped Tesla, while keeping Exxon. How are investors meant to make sense of all of this?

A dichotomy has also emerged following the war in Ukraine. The situation makes commitments to reduce the use of fossil fuel, challenging in the near term. Longer term, it could accelerate renewables adoption to help achieve energy independence, but it shows the road ahead could be rocky. Spikes in commodity prices tend to disproportionately affect those on lower incomes as food and fuel costs make up a larger proportion of their overall expenditure.

So, who ultimately pays for the energy transition and how will the effects be managed? These are some of the questions that the concept of a just transition seeks to address. How does the transition out of high-carbon activities into greener ones happen in a way that workers, communities, and countries are protected while also maximising the benefits of climate action? The focus on real-world outcomes is certainly growing. ESG strategies have migrated from approaches largely focused on negative screening and exclusions to those centred on ESG integration. The next stage for the relevant industry participants will be evidencing outcomes and impact, which has traditionally been easier to do in private markets. The industry needs to demonstrate value to break through the scepticism.

LUX: How important is the role of governments and international frameworks such as the United Nations COP meetings in channelling capital to more sustainable activities?

JA: A global challenge requires a globally coordinated response. It is easy to view climate summits in isolation, but having closely followed their progress over several years, I would say the fundamental shifts are clear. I attended COP26—the climate change conference in Glasgow—in November last year. It was the most widely publicised climate conference ever. The scaled-up presence from the private sector was also noticeable. The Glasgow Financial Alliance for Net Zero—comprising 450 financial institutions—have pledged an eye-catching $130 trillion in capital to fight climate change. Investors, companies, and countries are now making net-zero targets the norm. So, if we look back to where we were at COP21 in 2015—where 195 countries adopted the first-ever universal, legally binding global climate deal—it is fair to say a lot of progress has been made since, but there is still a long way to go.

LUX: Is there sufficient data to quantify and price environmental and social issues?

JA: Third party tools and data help with benchmarking or as a starting point, but they can be unreliable in isolation, backward looking, or incomplete. Add to that the fact that ESG and sustainability issues are not uniform in scope, scale, or duration across industries and geographies. Ratings agencies combine data from different sources and condense that information into a score. This is a highly subjective process. What sources of information are used and why? How is the information sourced and “cleaned”? How are information gaps bridged? The methodologies and qualitative analysis used vary significantly between ratings agencies, so the scores produced tend to have a low correlation. As an investor you look at this and wonder which is closer to the truth.

Sure, clarity from standard setters and accounting bodies will help, but this does not replace the expertise that investment professionals offer. They have a deep knowledge of how governments, regulators, companies, and industries operate. At Lazard Asset Management, our investment professionals are responsible for incorporating ESG and sustainability-related risk and opportunity assessments into their relevant analysis and are supported by in-house expertise in ESG and sustainability—including in climate science, the energy transition, stewardship, and net zero—to help them contextualise and size issues when incorporating them into their applicable financial models.

Financial materiality is dynamic. Governance and human and natural capital issues that are material today may not be material in the future. Investors need a forward-looking, active approach.

Read more: Octopus Energy Founder Greg Jackson On The Green Revolution

LUX: What role does engagement play in making sustainable investments?

JA: I believe engagement is everything. Lazard Asset Management recognises that a company’s governance policies and board structure, environmental practices, labour policies etc, can materially affect a company’s long-term financial performance and therefore a security’s valuation. The firm’s fundamental analysts work together to understand issues that follow supply chains or impact certain geographies, and this is what gives our research depth. With this depth of knowledge, the professionals on our fundamental research platform can interact with management in a meaningful way to understand how this relates to corporate strategy and achieving better real-world outcomes.

LUX: What messages do you have for investors starting on their journey on sustainable investment?

JA: Firstly, I would say sustainable investing is no longer seen to be predicated on a trade-off between enhancing returns and having a positive real-world impact. Inadequate governance practices and poor stakeholder management can undermine a company—or even a country’s—long-term prospects, and this can later become negatively priced by capital markets. Secondly, investors need to be very clear on their objectives. Are they ESG-aware and seeking to incorporate financially material ESG issues into their investments and wanting company managements to be challenged on ESG issues that are a cause for concern? Are they sustainability focused—i.e., believe the world is transitioning to a greener, fairer, healthier, and safer place –and wanting to capitalise on this as a structural theme? If so, bottom-up, fundamental strategies can identify the winners and losers from the transition to a more sustainable economy. Beyond this is impact investing, which has a much higher threshold again, and is about evidencing both intentionality and additionally. Every type of investment has different risk-reward profiles. It’s about identifying which ones align with your investment beliefs and objectives.

Find out more: lazardassetmanagement.com/sustainable-investment

Recent Comments