The Buckingham Gate entrance at Northacre’s No.1 Palace Street development

Luxury real estate developer Northacre was founded in 1977 by German architect Klas Nilsson. Owner of The Lancasters, a luxe development of 77 apartments in Bayswater, the company is currently developing No. 1 Palace Street, a Grade II listed building featuring 72 apartments overlooking Buckingham Palace’s Gardens and The Broadway in Westminster, which will be composed of six residential towers framed around a 20,000sq ft public thoroughfare and pedestrianised piazza. LUX Associate Editor Kitty Harris speaks to CEO Niccolò Barattieri di San Pietro about Brexit, millennials and the importance of understanding your customer

Niccolò Barattieri di San Pietro

LUX: Northacre provides management, interior architecture and design services. How do all of these components work together?

Niccolò Barattieri di San Pietro: How would it function without it is the question. I am always surprised to see other developers that don’t have an interior designer or architectural arm in-house because ultimately, what are we selling? Hopefully, beautiful apartments that people want to live in, and hence you have to create the emotional attachment between what you do and what they’re buying because without it you don’t create a premium. For us, the central part of our DNA is the design. Northacre is the only development firm in central London that was started by an architect. Klas Nilsson started Northacre roughly 30 years ago – he was a pioneer in space and an architect hence design has been at the core of what we do and not an add on. It’s a 360 degree holistic approach to developing.

LUX: Do you think there are irresponsible and responsible developers?

Niccolò Barattieri di San Pietro: You know I don’t know if it is about being responsible or irresponsible, I think there is a naivety and short-sightedness in cutting corners. The most important thing that Northacre has is its track record, doing the same thing thirty years in a row and doing it successfully. And so it would be very short-sighted to CGI and erase buildings in front of ours in order to make ours a better view because it takes a client to visit once and then you’ve lost them forever.

Follow LUX on Instagram: the.official.lux.magazine

LUX: Do you have repeat customers?

Niccolò Barattieri di San Pietro: Absolutely, we have quite a few. We’ve probably sold close to 700 homes in central London in the high-end space. At the moment there are 330 transactions about the five million pound mark of which we have sold a decent percentage. One client of ours, who until very recently still lived in our show apartment at Kings Chelsea, subsequently bought another house in Kings Chelsea and he had bought 13 apartments at The Lancasters. He’s bought four more of ours at Park Street, and hopefully he will buy some at The Broadway too. He is a repeat customer, I think like many others, for several reasons. One is that he loves the homes, which I think is the crucial part of it. And secondly, the properties have done incredibly well investment wise.

If you look, for example, at The Lancasters, when we were doing bank evaluations they were saying no way would you be able to sell £1700 a square ft. because the area is at best £1000. A 70% premium is a damn good premium. But when we got it financed, the average sale price at the end was £2850. So yes, the market might have moved, but not from £1000 to about £2850 in the space of about 4 years. Even if it had doubled, it would be at £2000. So clients realised that we have quite a resilient product and in fact, the gentlemen that bought all of the developments I mentioned, decided he wanted to sell one at the beginning of this year. He was an early buyer, he bought in 2015, which we could argue was probably the peak of the market, he made 109% (£700,000) net return on his 10% deposit and it wasn’t on a small apartment in a market that’s gone down.

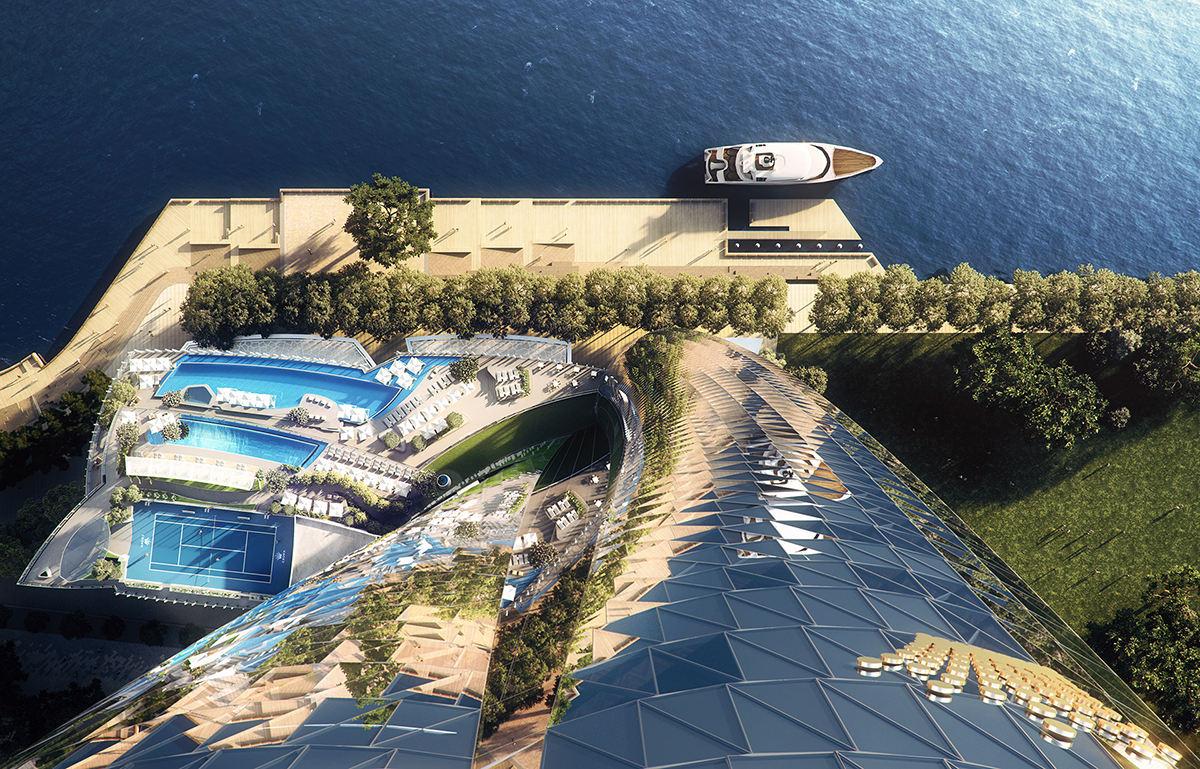

The lobby in The Broadway – a current development by Northacre

LUX: Which is your keenest market area and are you selling more now to millennial generations?

Niccolò Barattieri di San Pietro: Our markets really depend on the development because certain things that appeal to one kind of nationality do not appeal to another. Take two examples, No. 1 Palace Street and The Broadway. We retained the 1870s façade at No. 1 Palace Street, which overlooks the gardens at Buckingham Palace, but stripped the building completely so it is entirely new inside. The Asian market doesn’t see this as new and they don’t like older buildings so I would say that the largest group of buyers in that development are from the Middle East. Monarchy is very big there, they love it, and so you can see the different points of affinity between them.

When we bought The Broadway, we thought that it would be perfect for the Chinese market and for the Asian market in general because it was one of the very few mixed new build schemes where you are able to create a destination in central London of its size. It’s 1.7 acres and 268 units with all the amenities, and it has four world heritage sites around it. The mix of these two and its fantastic views resonates very well with them.

Read more: President of Monaco Boat Service Lia Riva on the romance of the riviera

Where do I start with millennials…they think very differently. We’ve found that millennials are actually very asset light. They love experiences, and they don’t want to be necessarily burdened by having a big asset whilst they could be travelling and creating experiences. And so we haven’t targeted them especially. We will be putting out a property that will resonate with millennials very soon, but it is a different beast completely and so we are looking to target that in a completely different way.

LUX: How do Northacre approach developing?

Niccolò Barattieri di San Pietro: Ultimately, we want to create an emotional attachment by making our buyers understand that we understand them. And I know it sounds like the ABCs of any company, i.e. understanding your customer, but look at some of the developments around you, it’s clear that the developer doesn’t understand their end customer. The reason is that there are a lot of improvised high-end residential developers because asset prices went up and high-end residential was the best use of these assets. They became high-end residential developers overnight and they don’t realise that it’s not an easy task. Hence they don’t deliver what buyers necessarily want. By understanding your clients, and knowing that real luxury to them is spending time with loved ones, we deliver something that creates an emotional attachment, enabling them at the same time, through in-house services, to focus on what they should be focusing on.

A master bedroom in The Broadway development

LUX: What makes The Broadway different to the other developments?

Niccolò Barattieri di San Pietro: The Broadway is a very challenging project; very few developers have ever delivered 268 high-end units in prime central London. But also it’s different in that it’s the first real mix-used scheme of high-end residential development in central London and many other cities. We believe this is the direction developing is going take, because you have got to create a sense of place that goes beyond the location itself. It’s important to control the types of shops and coffee shops on the site for the kind of buyer we attract. It’s also very important for the surrounding community because you are curating in an unexpected way by not putting generic shops in. Pret and Boots are fantastic, but we’ve seen enough of them. We are in a position to control that, which other developers can’t if it is just residential.

LUX: And how do you decide what locations to build on?

Niccolò Barattieri di San Pietro: The formula of Northacre hasn’t changed in the last 30 years. If you took a map of London and plotted all the Northacre developments by the year they were created, which is very important because areas change, you will see that the formula has always been the same. We develop in areas that are very central or very close to, but not in ‘the’ centre. We create a product that is better than anything else in that particular area, and then we play the price conversion. For example, No. 1 Palace Street: one would say ‘how absolutely fantastic to overlook Buckingham Place, but it would be nicer on the Mayfair side of Buckingham Palace’. Yes it would be, but on that side it was £6000/ 7000 per square ft. and this area is at £2000 and so we could push prices to £3000-4000. You need to understand the macro and micro of areas and of buildings themselves because it needs to become an aspirational building. The Lancaster was 140 metres of 1870s odd, white stucco façade overlooking Hyde Park. How many assets are there like that in London? Hardly any. How many times can you buy a whole block of 5 different architectural styles all in one next to Buckingham Palace like at No. 1 Palace Street? You can’t. So the fact that these buildings enable you to create an aspirational product, create additional value as well.

Read more: Model of the month Emma Laird on juggling acting and modelling

LUX: Do you think that phrase ‘re-defining luxury’ is dead?

Niccolò Barattieri di San Pietro: I never really understood the phrase to tell you the truth. For the simple reason that it might not be luxury to you, and it might not be luxury to me. Luxury is personal. For Millennials, like my son who is 16, ownership of an object is absolutely irrelevant. I said to him a few years ago: ‘When you turn 18 I will give you my watch’. ‘Why do I need a watch?’ was his response. Whereas if I gave him £10,000 for an incredible trip somewhere he would love it. So I’ve never been a fan of that phrase. I think you have to strike an emotional cord with people because that, to me, is how you convey luxury. Look at the things that the wealthy collect like art – how personal is art! You might love a painting I might not like it. Vintage wines too. All things are that are personal and rare – you cannot have the same that I can have.

The Swimming Pool at No.1 Palace Street – a development by Northacre

LUX: How do you think Brexit will affect the market, if it hasn’t done so already?

Niccolò Barattieri di San Pietro: It will affect it but there are many things that are affecting the market in general. We have to take a step back for a second and consider that from 1994 to 2014 we had twenty years of a booming market. We shouldn’t be too surprised that there is a pause in this market.

And what does Brexit do? First of all we don’t know what Brexit looks like because no one does. We only know it creates three things. Two that are negative and one that is positive. The first one is uncertainty. No one likes uncertainty, and in times of uncertainty asset prices don’t go up and it doesn’t give buyers a sense of urgency. Second, it is creating an opportunity for foreigners because the pound is weaker, which is the positive. However, this also has a negative ramification to it as well. This being that the weak pound gives an excuse to a lot of the foreign work force working in construction to go back home because their countries are booming more than they were before. They are now sending much less money home than they were before because £1 before was €1.40 now it is €1.14 – a very big difference.

If you look at it more granularly though, what I think is really happening is the market has become binary and it goes back to the fact that you have a lot of improvised high-end residential developers that are creating a product that does not actually meet what people really want. And so when someone says ‘the high-end market is down 15% from the peak’, that is a very misleading number because yes, if you take the who aggregate of it, but if you then look at properties that are actually really nicely developed property by a reputable developer that don’t have any compromises to it, there aren’t many and so the developer still has pricing power. It is not because the customer has become poorer all of a sudden, he is just picky, and rightly so because he is spending a lot of money. So the other developers that are developing a product that is not really ticking all of the boxes can’t attract the high-end market because those buyers want to spend their money on the best. They are not interested in something, even if you give them a 20% discount, they will say: ‘But I still don’t like it, it is not that I like it more’ so then they have to start selling to a different kind of market and that’s why the prices drop because the other buyer says, ‘OMG, it is nice and so expensive.’

LUX: What are your future predictions?

Niccolò Barattieri di San Pietro: Did you bring the crystal ball?! We do have to look ahead, I think that there are clear trends in the market in general that have nothing to do with high-end residential. I think high-end residential is going slightly back to basics in the sense that for a long time you had developers that thought that the more expensive the property, the more you have got to put in it. And everything has to be covered up because that is going to give a sense of luxury and how much they have spent. Electronics, big screens everywhere etc. The fact is that high-end people like to turn the switch on and off and the button for fading the light is the most they want to see, right? So we are stripping back the technology to basics. And the sense of luxury really is the beautiful light switch. To touch it there’s a sense of satisfaction, it is bit like a door handle that it is the right length, the right thickness, the right feel, the right weight. We are really focusing on those subtleties.

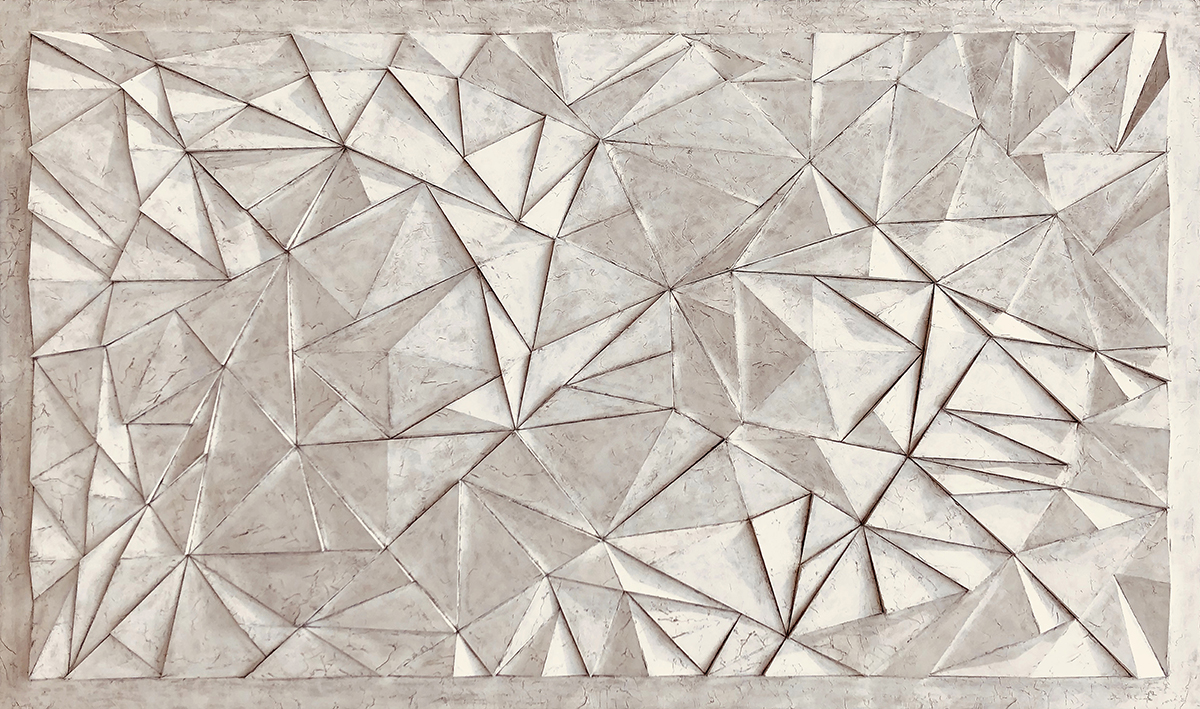

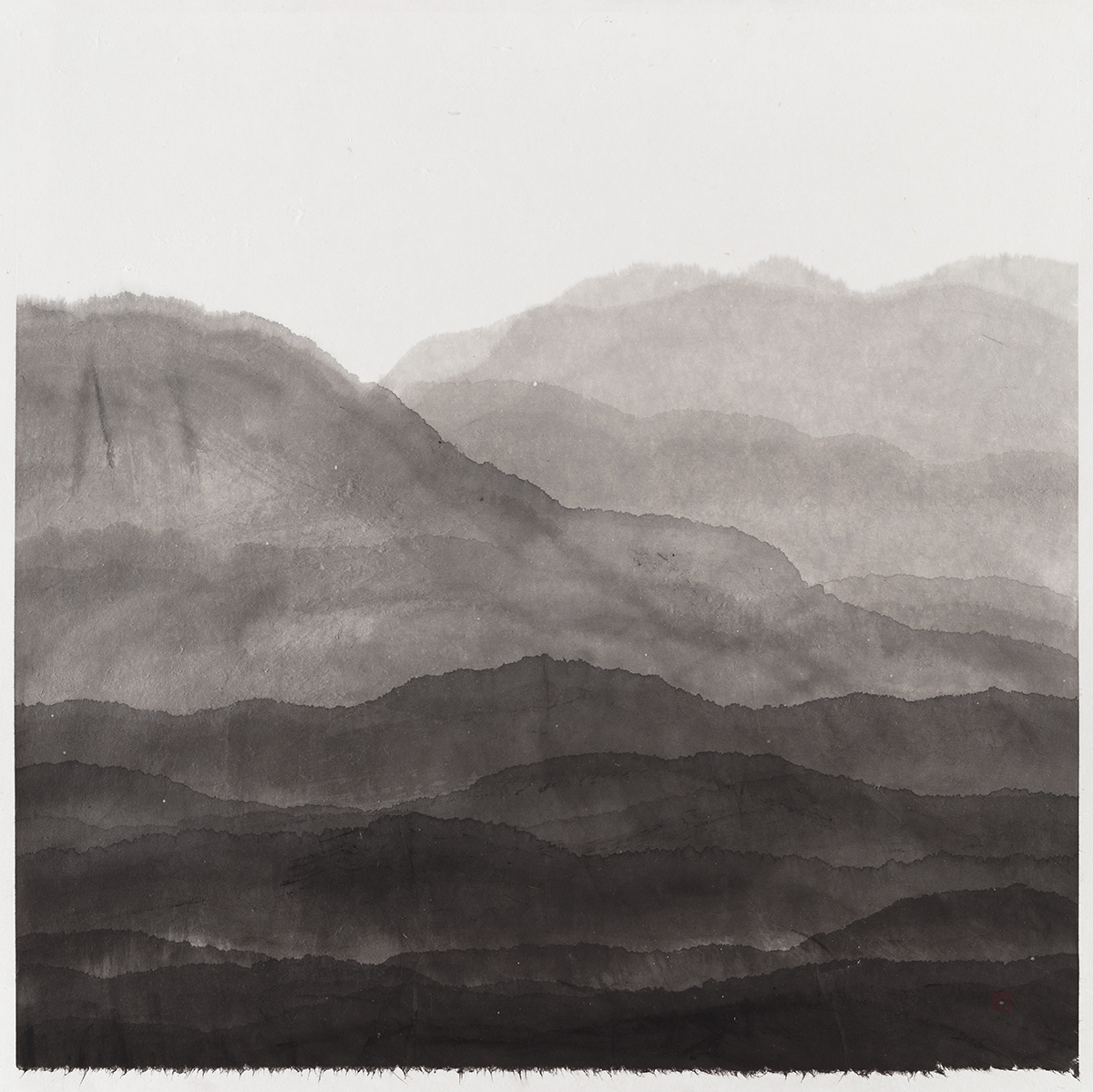

And then there is nothing wrong with a white wall, because ultimately, for these customers, it’s about the art that they are going to put there. All their friends have nice apartments, they don’t need to go and show it off. But what differentiates them is that they have art that nobody else can have because it is one piece. And so how do you create gallery spaces? How do you create as much wall space as possible? So these are the trends that I see: the pairing back, the few great materials and simplicity, ultimately.

Read more: Why you should be checking into Monte Carlo Bay, Monaco this month

The other trend is really focusing on the staff of the development, so the concierge, the valet etc. How do you enable them to deliver the service you talk about them delivering? I’ll give you a practical example, when we were doing No.1 Palace Street and I was new at Northacre, I said let’s go and interview all the guys that work at the front desk in our past developments. Let’s learn from them because they are the ones that are in the front line. And it is interesting that they were saying, at the Lancaster they were saying: ‘you know we receive two bags of mail every single day, we receive three racks of dry cleaning every single day. Northacre did not give us enough space to put all of these things, and so we’ve got a few there, a few there, a few there.’ These are things you have to consider.

We are also creating an app, where you will be able to do everything from booking a massage to making sure the car comes up to seeing your service charges to booking a personal trainer, so that everything is done in a very, very simplistic way. That then frees up the time of the guys downstairs and enables them to deliver the best possible service.

LUX: Do you have your favourite residential area in London?

Niccolò Barattieri di San Pietro: Well, I have been living in Chelsea for 21 years now, so that is my neck of the woods. I love it because it feels like a little village, but at the same time, you are 100 metres away from the hustle and bustle and if you have got to get to other central parts of London it is super, super close and it is very close to my office. But there are a lot of exciting places in London, not only where we develop, but also some parts of the East End are super interesting, and I think that how they are attracting tech start-ups is incredibly interesting. And actually the East End is really starting to cater to the millennial generation. Anywhere you go in London houses are very expensive. And so we have to start finding a new model based on how people will be living that also reflects how the millennials think, and that is what we are working on at the moment.

According to Niccolò Barattieri di San Pietro, No.1 Palace Street has been Northacre’s most challenging development to date

LUX: What has been the most challenging development for Northacre?

Niccolò Barattieri di San Pietro: No.1 Palace Street without a doubt! It has five architectural styles in one block with a façade retention of about 70% of the original façade with a great tall building in the middle. We had to demolish everything inside and dig down four floors underneath. We are doing a top-down construction approach, where you pour the ground floor slab, and then you start digging down whilst going up at the same time. The façade is not thick at all so it’s scary because you are creating the structure and then you have to tie it all back together. And obviously these façades are delicate.

LUX: Don’t blow!

Niccolò Barattieri di San Pietro: Exactly. When there were high winds last year we were praying a crane didn’t move, because can you imagine? Who is going to go to Westminster and tell them that the façade has come down?

LUX: We hear you are a keen sailor. What’s been your most memorable voyage?

Niccolò Barattieri di San Pietro: I sailed from the South of France to Hawaii and then from Hawaii to San Francisco. I did about 15,000 miles on a 39 ft. catamaran. The first 2,000 miles I did without a GPS – it was a fantastic trip!

To find out more about Northacre’s past, current and future developments visit: northacre.com

Recent Comments