Italy retains its place as one of the most desirable second home destinations in the world, says Andrew Hay. This property, Le Bandite is located in Umbria with easy access to Rome

Lord Andrew Hay

Lord Andrew Hay is Global Head of Residential at Knight Frank, the international real estate consultancy, and has built up property portfolios for some of the wealthiest people in the world. In a new regular column, he is handed a theoretical sum of money by LUX and asked how he would invest it. We kick off by handing Lord Hay £100m and requesting a global residential property investment portfolio

When LUX’s Editor-in-Chief generously offered me the opportunity to “invest” £100m into property, I was unsurprisingly delighted to accept. I have had free rein on where and what I buy, but have decided to invest with both my head and my heart. The reason being – I want to enjoy the properties I purchase but also have a clear focus on investment returns.

With this in mind, I have divided my allocation into equal thirds, between high-end luxury residential property, residential investments with a focus on capital growth and rental returns and investment into student property and senior living. The final 10% I would invest into an agricultural portfolio.

Follow LUX on Instagram: the.official.lux.magazine

I have to start in London. Often the best investment strategy involves an understanding of which markets are the least fashionable at the moment – and with Brexit and tax hikes London has been underperforming in recent years.

With few London neighbourhoods having a global brand as strong as Chelsea’s, I firmly believe that Chelsea is the perfect example of an area that has been underperforming and which is now ripe for reassessment.

Prices here have fallen 20% since late 2014, compared with a 12% fall across the wider prime London market. While new-build property in this category achieves a premium, established property trades at between £1,200 and £1,800 per sq ft. With many properties now edging below £1,000 per sq ft, Chelsea is back in the spotlight and cheaper than some less central and glamorous neighbourhoods.

Interiors of a luxurious villa residence overlooking Lake Como

Yes, the area still lacks the connectivity of other prime neighbourhoods. However, with easy access to the river, unrivalled shopping on the King’s Road and Fulham Road and some of London’s best schools within walking distance – including the Lycée Charles de Gaulle and the London Oratory School – and the promise (or maybe hope) of a station on the future Crossrail 2 underground railway, Chelsea is set for rediscovery.

The next place I would invest is the other side of the world: New Zealand. New flights and rapidly increasing connectivity to Asia means the country is increasingly becoming a go-to destination. Auckland is the logical entry point and investment destination. One location in particular stands out to me – home to the 2021 America’s Cup, Wynyard Quarter is changing fast. Over the past decade, this waterfront precinct, once the heart of Auckland’s marine and petrochemical industries, has emerged as a major hub for national and international corporates, including Fonterra, Datacom, Microsoft and ASB Bank, as well as for the city’s innovation and co-working scenes.

Read more: Ruinart x Jonathan Anderson’s pop-up hotel in Notting Hill

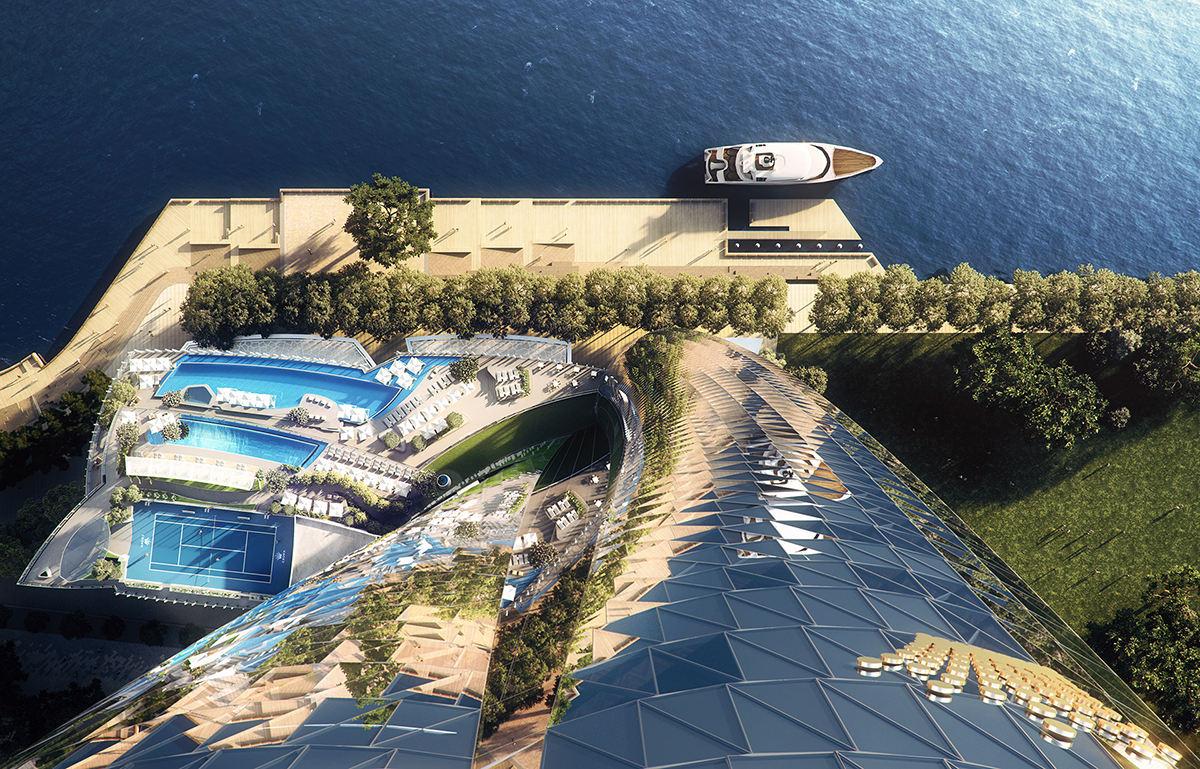

Staying in Australasia, I have to include Sydney in my portfolio – a market that has seen a huge growth in investment over the past two decades from around the world. The city may be remote, but education has been a driving force in attracting Chinese purchasers. The one location I would target is One Barangaroo – Crown’s new development. One Barangaroo is one of the most beautiful developments in the world currently being built and is achieving record prices on the shores of Sydney Harbour overlooking the bridge and the Opera House. It has brought a new global standard of facilities and services to the city.

New York design firm Meyer Davis have crafted designed the interior layouts of residences at One Bangaroo

View down to the harbour from One Barangaroo, the latest residential development in Sydney

In Europe, Italy retains its place as one of the most desirable second home destinations in the world. The new flat tax initiative however has cast the country in a new light as a potential permanent base for the world’s wealthy. Italy is certainly worth a closer look. Property prices in many Italian prime markets declined 40% in peak-to-trough terms following the financial crisis, interest rates remain at record lows and the country is better connected than ever before.

In the US, the West Coast is of especial interest to me, the combination of lifestyle and economic dynamism here is unparalleled anywhere else in the world. One area which appeals to me is Pasadena. Home to the Rose Bowl stadium, NASA’s Jet Propulsion Laboratory and the California Institute of Technology, Pasadena offers an attractive combination of relative value compared with neighbouring communities in Beverly Hills and West Hollywood, and the desirable lifestyle and privacy that residents of Los Angeles seek. The neighbourhood is easily accessible, with a light rail line that puts it within 15-20 minutes of Downtown Los Angeles.

Read more: Kuwait’s ASCC launches visual arts programme in Venice

In terms of growth areas I would point to student accommodation and retirement. Student in particular is counter cyclical (i.e. typically more students in a recession). Participation in tertiary education globally is increasing – OECD predict 8 million internationally mobile students by 2025 (up from 5m today). Markets remain structurally undersupplied. In terms of where Sydney looks good it has a big student population and low pipeline due to shortage of development land. In terms of development, I like big European cities like Barcelona, Lisbon and Paris. European markets comprise with very little existing organised supply. Europe is new front for portfolio development, scale building and brand.

At the opposite end of the age scale is senior living where the market is undergoing rapid growth, underpinned by demographic shifts that are increasing demand for a wider array of specialist housing to suit the changing needs of older purchasers. London and the South East, Bristol and Edinburgh are key UK senior living markets. Globally, America, Canada and Australia are at the forefront of investment.

Finally I would invest in farmland. Choosing where to invest in agricultural land depends very much on your appetite for risk but the world faces both a water shortage and food shortage by 2040 and 2050 respectively and therefore, investors looking at long-term food security are well advised to invest in agricultural land. With the world’s fastest growing population, Africa offers some very exciting opportunities. Zambia, for example, provides a good balance of relative political stability and established infrastructure. The Asia-pacific region is seeing a huge growth in wealth and rain-fed farms on the east coast of Australia are well placed to take advantage of this market.

And, that’s my £100m invested.

Find out more: knightfrank.co.uk

Knight Frank’ Wealth Report directs ultra-high-net-worth individuals on where to invest in property and reflect $3 trillion of private client investment into real estate annually. The countries that have been most robust and performed best over the last decade have been those where there is a steady political and economic situation as well as transparent rule of law, high quality living and first class education. The above portfolio choice reflects this.

Recent Comments