Portia Antonia Alexis is a leading consumer business analyst, neuroeconomist and mathematician

Portia Antonia Alexis is a consumer goods analyst and researcher specialising in the realm of neuroeconomics, where she uses advanced analytics to determine the thought processes of consumers and how best to appeal to them. Here, the McKinsey alumnus speaks to LUX about the impact of the pandemic on consumer habits and the future of hard luxury

LUX: How do you define hard luxury?

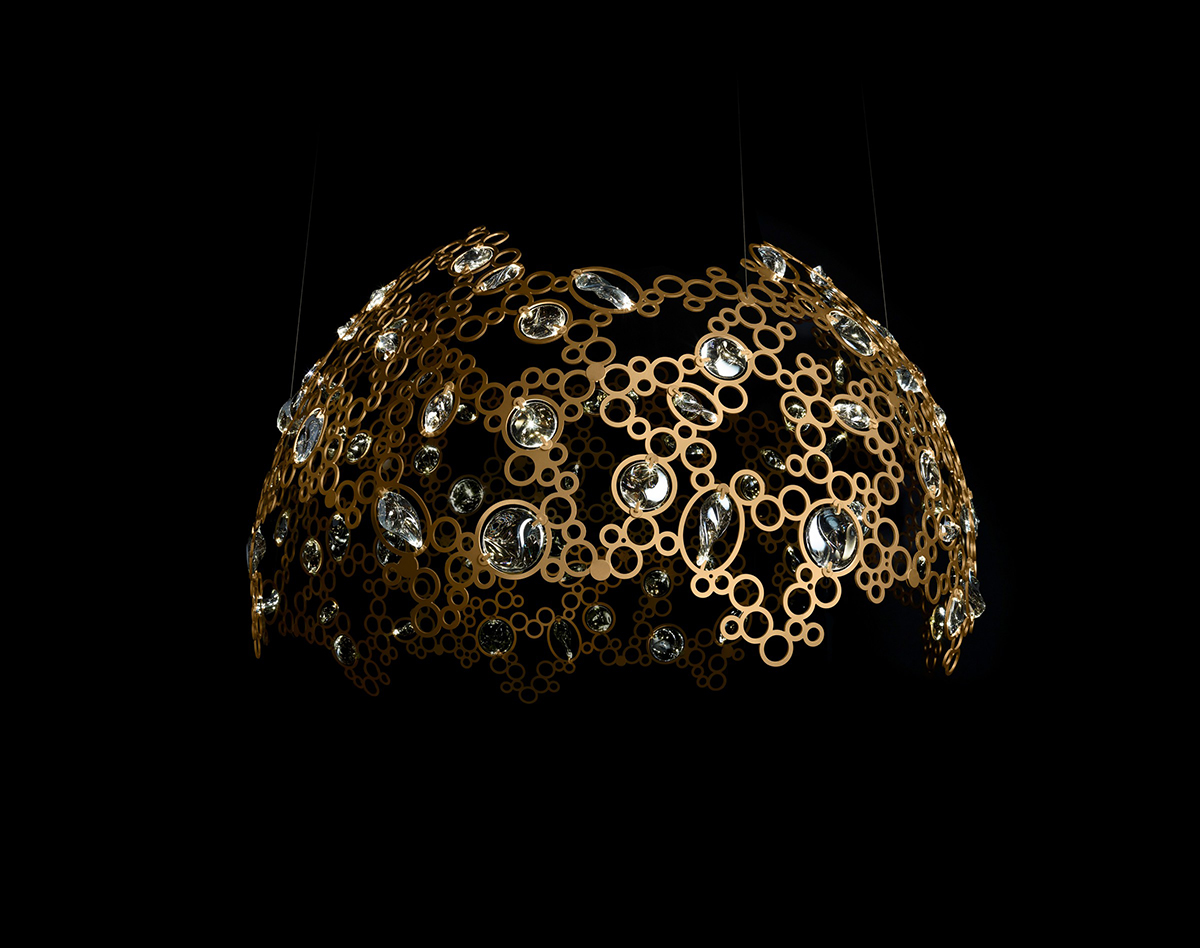

Portia Antonia Alexis: Hard luxury is simply a term that refers to timeless products such as watches and jewellery, while soft luxury refers to products such as leather accessories, bags, and designer clothing. While this may sound a little basic, an easy way to remember the difference is that hard luxury refers to pieces that are physically harder to break, while soft luxury refers to pieces that are soft to the touch.

LUX: What was the relationship between hard luxury and e-commerce pre-pandemic?

Portia Antonia Alexis: Pre-pandemic, hard luxury goods were very rarely sold online. After all, while major hard luxury retailers such as Tiffany & Co., Longines, and Rolex consistently advertised through online channels, the idea behind these advertisements would be to drive people to their in-person stores rather than try to drive online purchases.

Follow LUX on Instagram: luxthemagazine

The reasons behind this can mostly be attributed to the price of hard luxury brands. Generally speaking, a high-quality piece of jewellery or a luxury watch will cost over $1,000, and in an online setting, many people were uncomfortable with spending such a large sum of money. Online shopping was also much less conducive to driving sales, as while an in-person salesperson could use sales tactics to condition the brain into making a purchase, the nature of an online shop made it much harder to do so. As a final note, many people enjoyed the experience of shopping for hard luxury in-person, as they get a psychological ‘high’ of sorts due to the increase in perceived status that they felt when shopping for an expensive item in person; however, when online, this reaction was greatly muted.

LUX: How has the hard luxury sector been affected by COVID-19?

Portia Antonia Alexis: As with many industries, hard luxury sales plummeted during the first few months of the pandemic, but by the third quarter of 2020, there was a large resurgence in sales. For example, in the third quarter of 2020, the luxury conglomerate Richemont had a 5% increase in sales that was largely bolstered by its jewellery assets and during that same time period, Maisons had a 13.3% increase in sales, which was largely thanks to a strong performance by its hard luxury brands Cartier and Van Cleef & Arpels. I expect to see this positive momentum continue in 2022, and I would not be surprised if hard luxury revenues meet 2019 levels this year.

LUX: From a neuroeconomic standpoint, why do you believe this rise in sales occurred?

Portia Antonia Alexis: Given that most hard luxury brands were reliant on in-person traffic to drive sales, the pandemic necessitated a complete revamping of the online experience so that these brands could replicate the same psychological triggers that shoppers felt when they were in-store.

One of the biggest innovations in this field was the advent of personalised online appointments. These appointments involve a salesperson booking a time with a client and then having a video conference where they have their entire collection on offer, and these were great substitutes for in-person appointments for two main reasons. The first was that the salespeople were able to use many of the same sales tactics that they used in store, and from a neuroeconomic standpoint, this generated a more positive response in the brain of the client that then led to a higher conversion rate than a simple online store would have. The second major difference was that the salesperson could physically try on a piece of jewellery, and this was important because it not only allowed the client to analyse the fit of a piece using a real person as a point of reference, but made the client more comfortable with shelling out large sums of cash for an item.

Read more: Prince Robert de Luxembourg on Art & Fine Wine

Another major innovation was the increased emphasis on customer service. On a basic level, this was done by having more people on hand to answer questions and do sales calls and by making the waiting time for answers either online or on the phone much shorter. This helped give clients peace of mind while shopping, alleviating a lot of the unknowns that come with purchasing while only having a picture as a frame of reference. This customer service also extended to details such as warranties and returns. In the past, many hard luxury companies had strict return policies, but in light of the pandemic, many made it so that you could try a piece on and then return it if necessary. This was crucial as it made people much more comfortable with making a large online purchase. However, since it is generally a bit of a hassle to return something, this barrier would cause many clients to mentally accept sub-par items, leading to items that would have been rejected in store still getting sold so long as they looked good online.

In tandem, these two factors made online shopping far more similar to in-person shopping than it was pre-pandemic, and as a result, sales were able to remain relatively high despite the fact that there were very few physical stores that were open.

LUX: Are there any other major factors that you feel were important?

Portia Antonia Alexis: I’d say that the influence of geographic variation cannot be overstated. While business in the United States was lacklustre, China and Japan, which are the second and third largest luxury markets by annual sales respectively, became especially influential after removing their COVID-19 restrictions earlier than most. That’s because there was a marked rise in ‘revenge buying’, which were shopping sprees driven by a feeling of having missed out during the lockdown, and ‘reunion dressing’, which were surges in demand driven by re-uniting with people after large periods of time in lockdown, and in tandem, this led to a massive growth in sales in these countries. In fact, mainland China was the only region on the planet to come out of the COVID-19 pandemic with higher local spending than it had in 2019, as it experienced a massive consumption growth rate of about 45%. When you further consider the increase in per capita wealth being generated in China, I’m confident that in the next few years, China may overtake the United States as the world’s leading hard luxury market.

LUX: What will hard luxury companies have to do to encourage growth post-pandemic?

Portia Antonia Alexis: I think that one of the single most important changes that hard luxury companies will have to undergo is the shifting of their focus from the American market to the Asia-Pacific one, with China being their primary long term target.

Research has shown that relative to American consumers, Chinese consumers tend to have very different responses to advertisements. More specifically, it seems that while American consumers respond well to brand awareness, which is created by, say, commercials at the Super Bowl, Chinese consumers tend to be far more concerned with intrinsic value, which derives from factors such as the quality of the materials used, how the goods are created, and what the brand’s story or ethos represents.

Chinese consumers also seem to respond poorly to discounted merchandise. Now, during the pandemic, many American brands dropped prices or released lower cost lines of products in order to make their goods more affordable to cash-strapped consumers. However, this often backfired in the Asia-Pacific, where consumers perceived this fall in prices to be a drop in intrinsic value, which therefore made the goods less desirable than they were before the prices were decreased!

In any case, I think that if American brands are to fully take advantage of the Chinese markets, they will have to focus more on building a long term story for their brand and less on simply creating a recognisable logo with flashy advertising. However, given that the Chinese and American markets are so large yet so different, the big challenge here will be to straddle the competing consumer mindsets in both regions. In my opinion, hard luxury brands can achieve this by applying different neuroeconomic principles to their marketing campaigns and brand building on a regional basis, and my hope is that in the coming years, more analysts with a neuroeconomic background will enter the consulting field so that this can be achieved!

Portia Antonia Alexis is a neuroeconomic consumer goods analyst and researcher who works with luxury brands such as L’Oreal, Estee Lauder, and Tiffany & Co. @portiaeconomics

Recent Comments