Nur-Sultan, the capital city of Kazakhstan with landmark Baiterek tower. Image by cosmopol.

Dynamic leadership and entrepreneurial thinking are required to help the global economy recover. We speak to seven leaders in the Kazakhstan chapter of one of the world’s most respected business organisations about mutual support among entrepreneurs, and their country being a touchpoint between east and west. Curated by Gauhar Kapparova

LUX’s Editor-at-Large Gauhar Kapparova

A first-time business visit to Kazakhstan is likely to end up with two overarching impressions. Firstly, of the sheer size of the country. The distance from the biggest city, Almaty, to the centres of oil production on the Caspian sea is an astonishing 3,000 kilometres. Even the short hop from Almaty to the shiny new(-ish) capital Nur-Sultan is an hour and a half on a plane.

The second impression is likely to be one of the openness and dynamism of a new entrepreneurial community. Kazakhstan often speaks of itself as a key country between east and west, with China to the east and Russia and the Caspian sea border of Europe to the west. It is also focussing on moving beyond its oil and gas-based 20th-century economy, with the majority of growth coming from other sectors.

To this end, the country teems with spirited, can-do entrepreneurs, unfazed by the distances they have to travel to get to the world’s financial centres and proud of their country’s potential. A new generation of largely western-educated business people add to the cosmopolitan feel.

Follow LUX on Instagram: luxthemagazine

At the heart of this enterprising business community is the Kazakh chapter of YPO (Young Presidents’ Organization), a global members group for chief executives and owners of significant businesses. Entry is by invitation only and open to those who own or run substantial businesses. Benefits are notable: an instant network of the highest level of contacts in your country and around the world, gatherings, conventions and seminars, and a highly sophisticated support network.

True to the country’s buccaneering business spirit, the Kazakh division of the YPO is known as one of the world’s most dynamic. There is no better insight into the opportunities in the central Asian country or into the minds of its prominent business leaders than from the YPO Kazakhstan chapter leaders we interview here.

ALINA ALDAMBERGEN

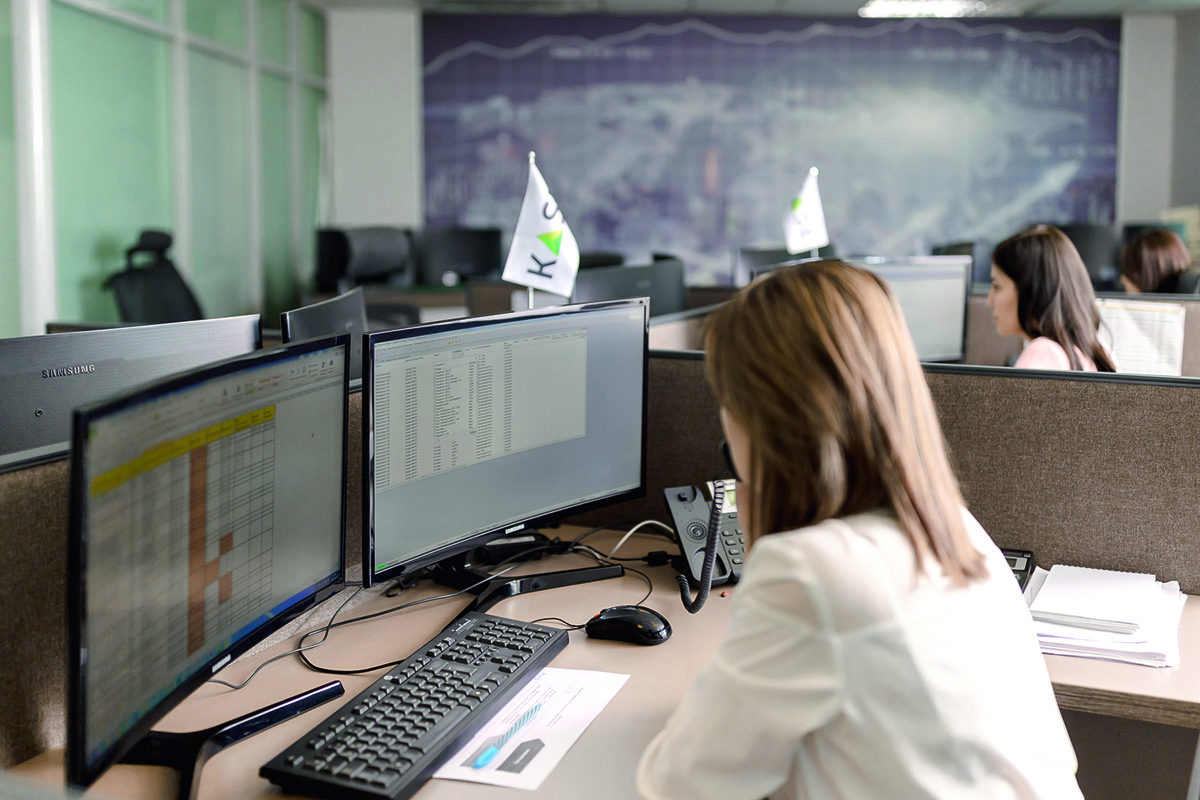

Chair of the Management Board, member of the Board of Directors of Kazakhstan Stock Exchange

Aldambergen’s career in the finance industry began in 1997 as an analyst and manager at ABN AMRO bank in Kazakhstan, then as a senior rating advisor in the global finance markets for the same bank in London before returning to Kazakhstan to chair the bank’s management board. After a series of senior posts at various financial institutions, she moved to the Kazakhstan Stock Exchange in 2016.

Alina Aldambergen. Image by Sergey Belousov.

LUX: Tell us about yourself and your experience. What distinguishes you from other YPO members?

Alina Aldambergen: I’ve been working at the Kazakhstan Stock Exchange since February 2016. In the 17 years since I was first appointed as chairperson of ABN AMRO Pension Funds Asset Management Company in Kazakhstan back in 2003, I have held a number of different management positions at private and state-owned companies.

My key expertise is in being a senior manager. Unlike other YPO members, I’ve never been an owner of a company. It is possible, of course, that one day I might decide to set up my own company, but I haven’t come to that decision yet.

I like to manage large-scale companies. It is important for me that I work for institutions that make an impact, which is why during the past ten years I have worked for companies in Kazakhstan that are owned by the state.

Read more: Deutsche Bank’s Claudio de Sanctis on investing in the ocean

LUX: How did you became the manager you wanted to be? How did you train and did you have any formal business education?

Alina Aldambergen: I happened to develop my career when the country was changing from the Soviet planned economy to a market economy. This was a significant transformation for the whole country, economically and mentally.

The country’s president was a visionary, he knew that this would require a new mindset and people with new sets of skills. That’s why the government set up a scholarship programme to send students to study abroad. I was awarded one of these scholarships and studied for an MBA at the Simon School of Business Administration at the University of Rochester, one of the top 25 business schools in the world at that time. I studied corporate finance and accounting, essential for doing business and setting up the financial system in Kazakhstan. Another major influence on my career has been working for the country’s first international bank.

Even though now I would think that doing an MBA straight from undergraduate school is a bit too soon, in my case it gave me all the essential skills to do business and manage business in Kazakhstan. I am still using all the concepts that I studied at business school in my everyday life.

Of course, I took various courses in different subjects later on, but still, the fundamentals are what keep you going. I am a strong advocate of keeping up your business education throughout one’s lifetime.

LUX: What motivated you then and what motivates you now?

Alina Aldambergen: I am motivated by excellence. However, that has to be adjusted for the environment that you are working in. At any job I have always tried to come up with the best business model, get support from the stakeholders, and follow it through. I will leave a company if my values do not coincide with those of the company.

I am a strong believer in not wasting time – why do so if you could be doing something more valuable and interesting elsewhere? It is important for me to bring worth to a company, its employees and shareholders, and to society. I want to see the results of my work make an impact.

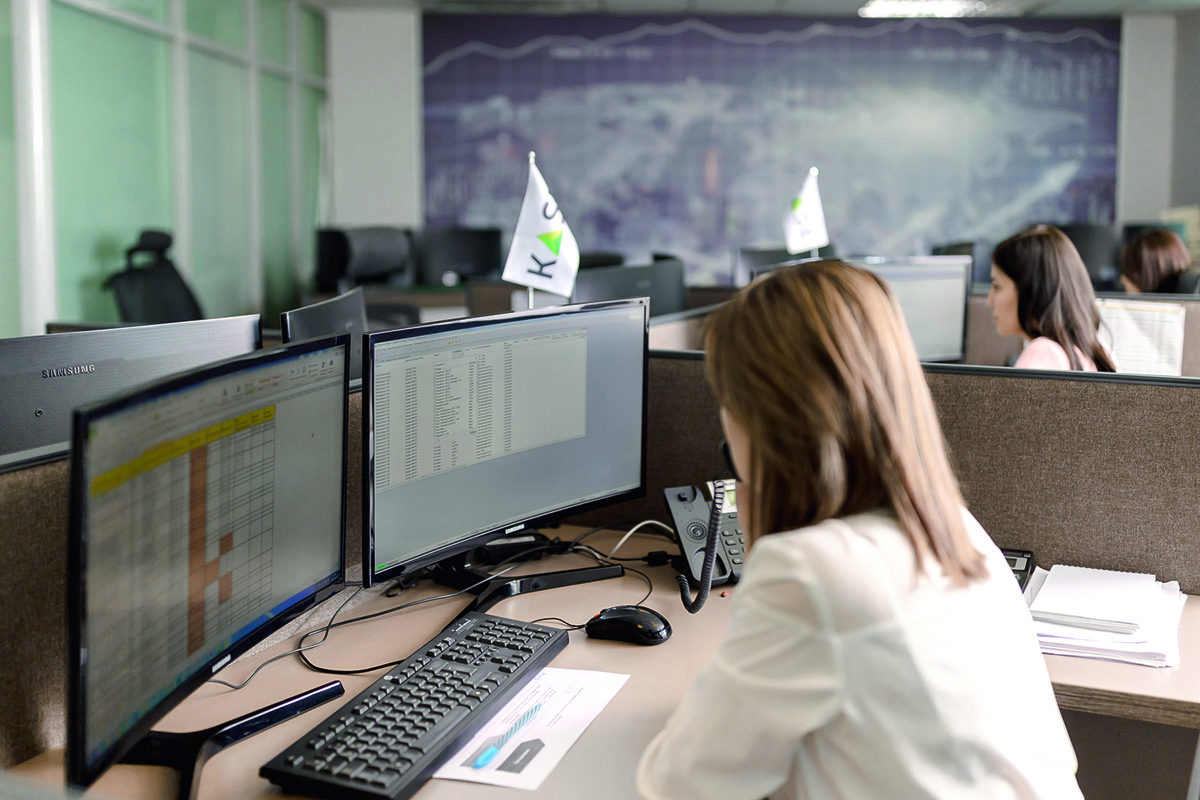

Courtesy KASE

LUX: Why did you decide to become member of the YPO? Why it is important for you?

Alina Aldambergen: I joined YPO in Kazakhstan in 2018. For me, it was an exclusive members club of business people – true, self-made achievers. To become a member was prestigious for me. Another point is that YPO is an international organisation, so in that regard I considered it as another step forward for myself. I also recognised that it is an influential organisation that can make an impact on various issues concerning society.

LUX: What else does YPO bring to you?

Alina Aldambergen: I think I discovered even more value once I had become a YPO member. There is a wealth of knowledge, significant networking opportunities and an exchange of opinions that you can draw on.

I like the YPO concept of oneself, family and business all together. I think it is important that YPO encourages this amongst its members. Your spouse or child can become a member of the organisation and it provides access to the same education as you can get elsewhere. It really enables generations of business people to grow.

I also like the forum meetings. I found that they are a place where you can receive and share professional advice with your peers on dealing with different situations. I think this is the most valuable experience of the YPO membership.

ARMANZHAN BAITASSOV

Chairman of the Tan Media Group and publisher of Forbes Kazakhstan magazine

Baitassov is a Kazakhstan media manager, professional TV journalist and businessman. He has founded multiple media outlets, including his first TV channel, Channel 31, in 1992 the Megapolis newspaper in 2000, the Business FM radio station in 2018, and in 1994 the Radio 31 radio station. In 2017 he was elected chairman of the board of the Kazakhstan Media Alliance.

Armanzhan Baitassov. Image by Andrey Lunin

LUX: What age were you when you thought you might go into business as a career?

Armanzhan Baitassov: I was 19 years old when I decided to go into business. The first time we thought about business was in the late 1980s, when it became possible to engage in private entrepreneurial activity.

LUX: Who were your inspirations in business and how and why did they inspire you?

Armanzhan Baitassov: We were inspired by the guys who were able to earn a lot of money back then in Soviet roubles, guys as young as us who were also searching for opportunities to make money.

LUX: What were your first steps? Did you have any formal business education?

Armanzhan Baitassov: We started in advertising, reselling the advertising slots in newspapers. At that time, there were no textbooks about business, so we learned everything along the way.

Read more: Sculptor Helaine Blumenfeld on the power of public art

LUX: What were the most important parts of this learning phase of your business life?

Armanzhan Baitassov: I graduated from the Faculty of Journalism at Kazakh State University and immediately went into the media industry, where I still work. Of course, in the early 90s there were problems with funding, there was not enough equipment or it was incredibly expensive, and legislation in Kazakhstan was not fully regulated. But we had enough advertising in the first year and big contracts with Procter & Gamble and Unilever.

LUX: What motivated you then and what motivates you now?

Armanzhan Baitassov: At first, the big motivation for us was creative work. We were young, we worked day and night to make our media more and more popular. Now, of course, we are more mature, but the main motivation remains to do something new to make our world better.

LUX: What are the unique challenges of business and enterprise in Kazakhstan?

Armanzhan Baitassov: There is the powerful influence of the state on the economy. It hinders entrepreneurship and corruption has penetrated all levels of power and the economy. Doing business in Kazakhstan can be simply unsafe, but there are also development institutions that are helping small and medium-sized businesses thrive. All systems work well, but look carefully at your segment, especially if it contains any state-owned companies and corporations.

The Forbes building in Almaty, Kazakhstan

LUX: What’s the secret of success in business?

Armanzhan Baitassov: For me it’s that I am interested in doing business, in watching companies develop and doing it myself, and not just being a shareholder and observing. When you are immersed, then you’ll succeed. And what probably helps is my belief that everything will get better every year.

LUX: What are your plans for the future?

Armanzhan Baitassov: The pandemic has changed all my plans for 2020 but I really want to develop media abroad in Russia, Uzbekistan and Georgia.

LUX: Who are your business heroes now?

Armanzhan Baitassov: Of course, there are people I admire such as Jeff Bezos, and Larry Page and Sergey Brin. There are also people here who inspire me, such as Vyacheslav Kim and Mikhail Lomtadze at Kaspi Bank. But today my business heroes are the young entrepreneurs in Kazakhstan.

LUX: The media business is going through unique challenges now. What do you think these are and where do opportunities lie?

Armanzhan Baitassov: The main thing is a sharp drop in income from advertising. Many media companies have begun to work remotely from home, which is a great opportunity because of the high office costs. There may also be greater digitalisation – print newspapers are living their last days.

LUX: When did you first hear about YPO?

Armanzhan Baitassov: I learned about YPO in 2010 from Nurlan Kapparov. A year or so later we went with him to the USA, where we were invited to an event held by the YPO chapter in Washington DC.

LUX: Emotional support in business and other matters seems to be an important part of being a YPO member – is that correct?

Armanzhan Baitassov: Yes. In Kazakhstan, most entrepreneurs encounter some difficulties, maybe even injustice, and we can openly discuss these within the chapter. It is an incredible support.

LUX: How does YPO support your business?

Armanzhan Baitassov: The biggest support that I get is when we hold events at Tan Media Group, almost all members are happy to come. I am especially pleased that they support the youth forum and are happy to speak to young entrepreneurs.

LUX: What does running the Kazakhstan YPO chapter mean to you?

Armanzhan Baitassov: It has become very influential. We want as many members as possible, but getting in is difficult. We have a committee that reviews all applications and only then sends them for consideration to the YPO members. We all feel a great responsibility, because each YPO member is one of our team.

AIGUL DJAILAUBEKOVA

Partner at InnoVision Management Consultancy

Djailaubekova began her career in banking 1996 in Amsterdam at MeesPierson and then ING Bank. In 2004, she returned to Kazakhstan to continue working for ING. Since 2007, her work in banking has included senior management roles at Citibank and HSBC in Kazakhstan and at large regional banks. At InnoVision she focuses on management consultancy, financial services and education.

Aigul Djailaubekova

LUX: What age were you when you thought you might go into business as a career?

Aigul Djailaubekova: I started my career about 25 years ago. Prior to then, being an ambitious straight-As student, I was set on an academic career but after a short teaching tenure, I decided to explore new opportunities in commercial and international business.

LUX: What were your first steps? Did you have any formal business education or training? Which companies did you work for?

Aigul Djailaubekova: I won a British Council scholarship to study at Lancaster University in the UK. After graduation, I landed a job in the Trade & Commodity Finance department of the Dutch bank MeesPierson in Amsterdam. I moved to ING Bank N.V., where for several years I covered financial institutions in various countries as a senior regional manager. Then I joined ING’s office in Kazakhstan as an expatriate manager.

LUX: What have you learned in your business life in recent years?

Aigul Djailaubekova: Over the past decade, I have been deputy chairman of the management board at Citibank and HSBC in Kazakhstan and in a few large local banks. Those were vastly different experiences for me in terms of their corporate cultures. All the successes and disappointments made me a stronger and perceptive manager as well as a more resilient and, hopefully, wiser person.

LUX: What are your business plans?

Aigul Djailaubekova: A few years ago I started thinking about setting up my own bank with a team of like-minded investors and banking professionals. In view of the multimillion investment required, it’s ambitious but most successful businesses at their early stages dare to dream big.

LUX: What are the unique challenges of business and enterprise in Kazakhstan?

Aigul Djailaubekova: It is important that foreign investors have a strong local partner who will be on the same page in terms of their business vision to help them navigate through the local bureaucracy.

LUX: Who were your inspirations in business and how and why did they inspire you?

Aigul Djailaubekova: My main inspiration in life is my family. I’ve always been driven by a desire to do something meaningful, to contribute to financial prosperity of our family, to be a good example for my children and to be a source of pride for my parents. Thanks to them and my husband, I have never had to face the choice of being a mother and wife or a being a banking executive.

Aigul Djailaubekova with her husband

LUX: What advice would you give anyone starting out in business?

Aigul Djailaubekova: I would say three things. Firstly, dream big and dare to have it all. One might not achieve each and every goal along the way, but it’s worth trying. Secondly, dare to follow your dreams, especially when you’re young. And thirdly, when you feel that the current trajectory is no longer satisfying, or that there are other opportunities opening up, dare to change to a new path.

LUX: How did you first hear about YPO?

Aigul Djailaubekova:Several years ago from some of my friends and business acquaintances. The Kazakhstan chapter was founded by Nurlan Kapparov, a highly respected businessman and visionary. It was very flattering when two of the long-standing members suggested I join, which I did more than five years ago. I was the first female YPO member in Kazakhstan.

LUX: Has being a woman member made a difference to the local chapter?

Aigul Djailaubekova: One of my missions was to break the image of our chapter as a closed, all male club. Later, I heard that initially some members had been cautious about a woman joining the chapter, but knowing several members before I joined and the fresh perspective and insights I brought helped me to gain the trust of other members.

LUX: How does YPO Kazakhstan benefit wider society?

Aigul Djailaubekova: Kazakhstan’s chapter has evolved from an elite business club to an organisation that strives to make differences in society. Some initiatives between the government and local businesses were introduced at the instigation of YPO. The charity balls supporting good causes are regular events now. And there are charity projects, such as the Ana Yui (Mother’s House) founded by one our members, which has become a nationwide movement saving thousands of babies from being sent to orphanages.

LUX: In what way does being a YPO member support and help you personally?

Aigul Djailaubekova: For me, YPO brings great value through business advices and insights and as a platform for personal development through the forums, training and special events. I have become good friends with most YPO members and their families, socialising outside official chapter events. When making a radical career shift, I took comfort from the forum and some closer friends at YPO to whom I could turn for advice.

SIDDIQUE KHAN

Founder and CEO of Globalink Logistics Ltd

Khan has worked in transportation since 1990. He established Globalink Logistics in 1994. In 2011 he was named Entrepreneur of the Year by the American Chamber of Commerce. As well as chairing multiple committees relating to his sector, he also advises Kazakhstan’s government on the development of transportation and has a particular expertise in the Belt & Road Initiative.

Siddique Khan

LUX: What age were you when you thought you might go into business as a career?

Siddique Khan: I started part-time work while I was studying to gain practical experience and to earn some extra money. It turned out to be one of the best opportunities of my life. I was able to learn how small businesses work, and the hands-on experience helped me turn my visions into practical business ideas.

LUX: Who were your inspirations in business, and how and why did they inspire you?

Siddique Khan: I was always fascinated with the ancient Silk Road and became particularly aware of it when I started a job in transportation and logistics in 1990 while supervising the distribution of humanitarian aid in Afghanistan. I saw the Silk Road’s heritage everywhere. In 1994, following the collapse of the USSR three years earlier, I set up a new business in Almaty to build a world-class transportation and logistics business that would eventually revive the ancient Silk Road.

Read more: Gaggenau launches initiative to support innovative artisans

LUX: How did you go about setting up this business venture?

Siddique Khan: Fundraising for a start-up to revive the Silk Road was anything but easy. After months of struggle, I managed to raise the seed capital, helping me launch Globalink Logistics on a shoestring budget. Choosing Almaty as a base was not a popular decision in those days, as most foreign investors were entering the former USSR market through Russia. Looking back, it was the right decision. It has helped Globalink gain recognition as the first international logistics company in Kazakhstan. Today, it has operations in nine locations in this country, more than 32 service centres in the former USSR and with representation in 55 countries.

LUX: What were the most important parts of this learning phase of your business life?

Siddique Khan: Companies have to re-invent themselves frequently, adapt to ever-changing market conditions, manage risk effectively, develop a competent workforce and invest in new technologies to be able to compete on a global stage. We must learn to overcome the uncertainty of the future and continuously educate ourselves to be able to stay ahead.

One of Siddique Khan’s company’s containers on the move

LUX: What motivated you then, and what motivates you now?

Siddique Khan: Giving financial success a purpose is still the most incredible motivation for me and gives me an enormous satisfaction in my work. My real thrill in life is not accumulating wealth, but to seek ways to use financial resources to create life-changing opportunities for others.

LUX: What are the unique challenges of business and enterprise in Kazakhstan?

Siddique Khan: Kazakhstan is a typical frontier market, offering high risk and higher reward. Overall, it and the Central Asian Republics are resource-rich economies with limited service sectors and infrastructures. There are viable business opportunities if one can cope with the numerous challenges of these emerging markets.

LUX: What advice would you give to foreign companies coming to Kazakhstan?

Siddique Khan: It is essential to learn and appreciate the cultural differences when you are doing business in this region.

LUX: YPO seems to be a unique business organisation. Is this true?

Siddique Khan: YPO is a unique group of exceptional executives that provides a network with a common aim: to become better leaders through lifelong learning. Every member seeks the knowledge and principles of success not only for their businesses but also for their families, friends and, most importantly, for themselves.

LUX: In what way does being a YPO member support and help you personally?

Siddique Khan: Much of the YPO member experience comes from the local chapter, where you meet other business executives in your area. Although the organisation attracts high-achievers who are very competitive, the chapter also offers a sense of openness. Chapter life is full of action, ranging from family retreats and business events to executive education, counselling, healthcare and much more.

Depending on the size of the chapter, there are several forums. A forum is a group of about eight to ten people who meet frequently to discuss business and personal issues in a judgment-free and confidential environment. Forums become the sounding board for topics that you wouldn’t like to discuss anywhere else. I can confidently say that my forum has become my family. We trust and support each other – no matter what.

The professional, educational, spiritual and networking support that I got from the organisation helped me not only to transform myself but my business and family life as well. Thanks to YPO, I have become a better executive, spouse, father and friend.

RAMIL MUKHORYAPOV

Chairman of the Board of Directors of Chocofamily Holding

After early enterprises in Moscow, Mukhoryapov returned to Kazakhstan in 2011 to work in e-commerce, founding Chocolife.me, the country’s first online marketplace. This has since expanded to become Chocofamily Holding, Kazakhstan’s leading internet company with eight brands covering services such as online payments, health, travel and food delivery.

Ramil Mukhoryapov

LUX: What age were you when you thought you might go into business as a career?

Ramil Mukhoryapov: I was 19 years old when I started my first business. It was a club for parties for students. My first idea was for a comfortable and fun student life.

LUX: Who were your inspirations in business and how and why did they inspire you?

Ramil Mukhoryapov: I was inspired by a few Russian and international entrepreneurs such as Richard Branson, Oleg Tinkov, Sergey Galitsky and Evgeny Chichvarkin. I was inspired by their energy and their desire to change the world.

LUX: What were your first steps – which companies did you work for, how did you train and did you do formal business education?

Ramil Mukhoryapov: I studied at the Financial University under the Government of the Russian Federation in Moscow. I used to read interviews with various entrepreneurs in the business newspaper Vedomosti, in which they described all sorts of business situations and how they dealt with them. Reading newspapers was my main training. I had no formal business education, just my basic finance education at the university.

LUX: What were the most important parts of this learning phase of your business life?

Ramil Mukhoryapov: I loved reading the biographies of top entrepreneurs such as Howard Schultz of Starbucks, Sam Walton, the founder of Walmart, Steve Jobs, John Rockefeller, Feodor Ingvar Kamprad, the founder of IKEA, and Richard and Maurice McDonald. I was inspired by their lives and their decision making.

LUX: What motivated you then and what motivates you now?

Ramil Mukhoryapov: At first I was motivated by money and the photos I saw in magazines that depicted businessmen like happy guys with beautiful lives. Now, my main motivation is to change the world. I would like to change the relationships between companies and employees, to change the service in our country and to create new possibilities in economics. I think that business people are sort of engineers of the world.

LUX: What are the unique challenges of business and enterprise in Kazakhstan?

Ramil Mukhoryapov: I don’t think that Kazakhstan offers any particularly unique challenges in business but it does have great potential for entrepreneurs, because of the very low levels of competition.

LUX: What advice would you give to foreign companies coming to Kazakhstan?

Ramil Mukhoryapov: First of all, welcome to our country! There are many great possibilities to start a business here. We are growing very fast, have a stable economy and political regime. Also, we have potential in retail, e-commerce and so on.

LUX: What is the secret of success in business and what keeps you going?

Ramil Mukhoryapov: I think that it depends on two things. Firstly, you should work a lot and very hard. And secondly, ambition. If you are not satisfied with the results, they have to push you to go further. It’s important not to say “enough” – that’s a very dangerous word in business.

LUX: What are your business plans?

Ramil Mukhoryapov: Our plan is to build the biggest e-commerce company in the region and to become the first tech company from Kazakhstan to be known worldwide. To keep pace with Amazon, Google, Facebook, Apple and others – that’s our goal and I believe that everything is possible.

LUX: Who are your business heroes now?

Ramil Mukhoryapov: My business hero now is Elon Musk. He is a person who makes crazy things. He does not just dream about something, he does it. He inspires me to think the same way. We shouldn’t build barriers in our minds.

LUX: When did you first hear about YPO?

Ramil Mukhoryapov: The first time was when I was a student. I read a book by Artyom Tarasov, one of the first Russian millionaires and the first YPO member from Russia. That was about 19 years ago and I knew then that I wanted to join YPO.

LUX: What were your perceptions of YPO before you joined?

Ramil Mukhoryapov: YPO is a unique business organisation. It consists of the best entrepreneurs from Kazakhstan and enables you to communicate with others from different countries.

LUX: How does YPO support your business?

Ramil Mukhoryapov: I have two examples. First, two of the YPO members in our chapter became investors in my company: Timur Turlov and Aidyn Rakhimbayev. Second, when I need to speak with the managers of the big Russian e-commerce companies, I can get their contacts through YPO Connect and they answer quickly.

LUX: How often are chapter meetings held?

Ramil Mukhoryapov: Formal meetings happen on average 10 times a year. They take priority in my schedule. I appreciate the ideas and advice I get from them – they are like a personal board of directors.

ELDAR SARSENOV

Chairman of the Management Board of JSC Nurbank

Before his banking career, Sarsenov led the marketing at TAG Heuer in the US and worked his way up to being deputy director of sales and marketing at Helios LLP, the Kazakhstan petrol station company. He was the managing director of JSC Nurbank for three years, during which he managed the credit card department, IT and marketing, before he became the bank’s chairman in 2015.

Eldar Sarsenov. Image by Valery Ayapov

LUX: What age were you when you thought you might go into business as a career?

Eldar Sarsenov: I started thinking of myself as some kind of business person when I was maybe six or seven years old. At the time, I was in the US living near tennis courts where I worked as a ball boy. It was then that I understood the value of being paid for your services.

LUX: Your family was prominent in business already – you took a very international route when starting your career. Why?

Eldar Sarsenov:My career started early, helping out in my family’s business when I was still in school. When in college, I did some internships and later on I was working in a few businesses in Kazakhstan, so my career started locally. My first international work was in New Jersey, at TAG Heuer, as part of my MBA.

LUX: Who were your inspirations in business?

Eldar Sarsenov: I was inspired first by my parents’ enterprise in the early 1990s. When I was in college, a few professors who were also successful business people also influenced me.

Read more: Kering’s Marie-Claire Daveu on benefits of the blue economy

LUX: What business education do you have?

Eldar Sarsenov: My bachelor degree in science and business administration was from Suffolk University in Boston, and my MBA is from Northeastern University. Formal education helped my decision making and my ability to assess business practices in all sorts of situations.

LUX: What motivates you now?

Eldar Sarsenov: That’s easy. I am motivated by problem solving, by overcoming crises. I look at the person I was prior to certain events and can see how they transformed and improved me.

LUX: What are the unique challenges of business and enterprise in Kazakhstan?

Eldar Sarsenov: It’s a great place to conduct business, but one of the biggest challenges is its population size. It is a little below 20 million and no matter how efficient or effective you are, technologically and otherwise, at some point you will hit the ceiling of what market you can get.

The flag of Nurbank, of which Eldar Sarsenov is chairman

LUX: What’s the secret of success in business?

Eldar Sarsenov: There’s no big secret. Work hard, be kind to people, be a good person, and stay motivated. That’s harder than it sounds. You’ll be motivated at first but, later, obstacles might slow you down. The trick is to keep moving.

LUX: What are your business plans?

Eldar Sarsenov: Going international is in the plan for me. As a company, you need to cover as many countries as you can. It is healthy and financially sound.

LUX: Who are your business heroes now?

Eldar Sarsenov: The ones who surround me, such as those who survived the break-up of the Soviet Union and prospered for the benefit of the country. Also my YPO friends, who are people of high ethical standards and great business acumen.

LUX: When did you first hear about YPO?

Eldar Sarsenov: I first heard about it through friends and business acquaintances. My friend and mentor Armanzhan Baitassov, who is a YPO member of some stature, suggested I join.

LUX: What were your perceptions of YPO before you joined?

Eldar Sarsenov: I thought it was something along the lines of a fraternity of some sort. But when I saw a meeting, which was informal, I was impressed by the comradeship.

LUX: In what way does being a YPO member support and help you personally?

Eldar Sarsenov: It’s put into perspective what I am today as a business person. It has shown me how my strengths could be furthered, and how my weaknesses can be minimised.

LUX: YPO seems to be a unique business organisation, especially in its forums.

Eldar Sarsenov: Yes, the forums are what make YPO so sought after. Chapters consist of five to eight people. They are designed to be part of the YPO experience, where people can meet regularly within their own groups and discuss problems with work, family, or personal development.

LUX: Does YPO help with international contacts also?

Eldar Sarsenov: International contacts are what YPO bring to the table once you become a member. It provides a platform called YPO Connect that enables you to connect with YPO people round the world. I have helped members from Latin America, Europe and Australia who were interested in financial services in Kazakhstan.

LUX: What does being a YPO chapter member involve and what do you need to do?

Eldar Sarsenov: You get from YPO what you invest. If you make time, reach out to people, follow guidelines at meetings and participate in forums, then YPO gives back a lot. Since I joined in 2019 I have tried to be at every event and reach out to every member. YPO has been great for me. I look forward to meeting new people after the pandemic, and I urge everyone to consider joining this great organisation.

TIMUR TURLOV

Founder and owner of Freedom Holding Corp.

Turlov is an entrepreneur and financial expert who established Freedom Finance in 2008. Becoming part of Freedom Holding Corp. in 2015, the company is a leading retail brokerage and investment bank in Central Asia and Eastern Europe. Turlov is a specialist in the US stock market and regularly comments, reports and lectures on financial and economic matters in business publications.

Timur Turlov, CEO of the Freedom Holding Corp.

LUX: What age were you when you thought you might go into business as a career?

Timur Turlov: I was hungry to earn money when I was at least 13. At 15 or 16 I had my first more or less serious job (as a junior media analyst) with an ‘adult’ salary.

LUX: Who were your inspirations in business and how and why did they inspire you?

Timur Turlov: I am not sure that I really can name any. I started my own business not because of my ambitions, but because my employer closed its investments arm.

LUX: What were your first steps? Which companies did you work for, how did you train and did you do any formal business education?

Timur Turlov: I have no formal business education. I started my career in the stock market industry in Moscow at a small proprietary trading firm founded by American who was a former Soviet Union citizen. Then I switched to a retail brokerage firm that was part of a medium-sized commercial bank, and became the youngest TOM manager by my third year. Then the investment arm closed after the 2008–09 crisis.

Read more: Prince Robert de Luxembourg on wine, gastronomy & storytelling

LUX: What were the most important parts of this learning phase of your business life?

Timur Turlov: I always was very practical. I learned a lot from my colleagues and partners, from googling and reading the necessary information to solve specific tasks.

LUX: What motivated you then and what motivates you now?

Timur Turlov: We live in a world where the winner takes it all and you need to be the best in the industry just to survive.

LUX: What are the unique challenges of business and enterprise in Kazakhstan?

Timur Turlov: The main challenge is being almost alone in your industry. A weak competitive landscape can be a problem when you eat your bread alone. And that’s an opportunity as well, of course.

LUX: What advice would you give to foreign companies coming to Kazakhstan?

Timur Turlov: Kazakhstan is a country of open doors. It’s very easy to get here and you will be warmly welcomed, but you have to manage expectations extremely carefully.

LUX: What is the secret of success in business and what keeps you going?

Timur Turlov: My ability to build relationships, to sense the direction the wind is blowing in and to create products that are in demand. And, of course, luck.

LUX: What are your plans and business dreams?

Timur Turlov: We need to expand more actively into the EU and from there, globally. Competition in my industry is already global and we need to grow to be competitive enough tomorrow, to be attractive enough to become a target for acquisition, or to acquire our competitors worldwide.

LUX: Who are your business heroes now?

Timur Turlov: My team, my competitors… No stars.

LUX: When did you first hear about YPO and from whom?

Timur Turlov: From my friend and client, Marat Shotbaev, three or four years ago.

LUX: What were your perceptions of YPO before you joined and what made you want to join?

Timur Turlov: I knew it to be a club of successful people from the business elite in our country.

LUX: YPO seems to be a unique business organisation. Is this true, and if so, how and why?

Timur Turlov: The spread across medium and large enterprises in Kazakhstan seems to be wider than usually found elsewhere in the world. So here, YPO is a club for large businesses.

LUX: In what way does being a YPO member support and help you personally?

Timur Turlov: Through the unique experience of the forum meetings, which unfortunately have been less frequent over the past year because of the Covid-19 pandemic.

LUX: How does being a YPO member support your business?

Timur Turlov: Business is always about the development of relationships, and YPO helps to develop it much further.

LUX: Does YPO membership help you with international contacts as well?

Timur Turlov: I have never tried to use the international power of YPO.

LUX: What does being a YPO chapter member involve? How frequently do you have formal meetings, and international meetings?

Timur Turlov: Unfortunately, I have never participated in any of the international meetings, but this is only my second year of membership and international travel has been restricted, of course, for most of 2020.

Find out more: ypo.org

This article features in the Autumn Issue, which will be published later this month.

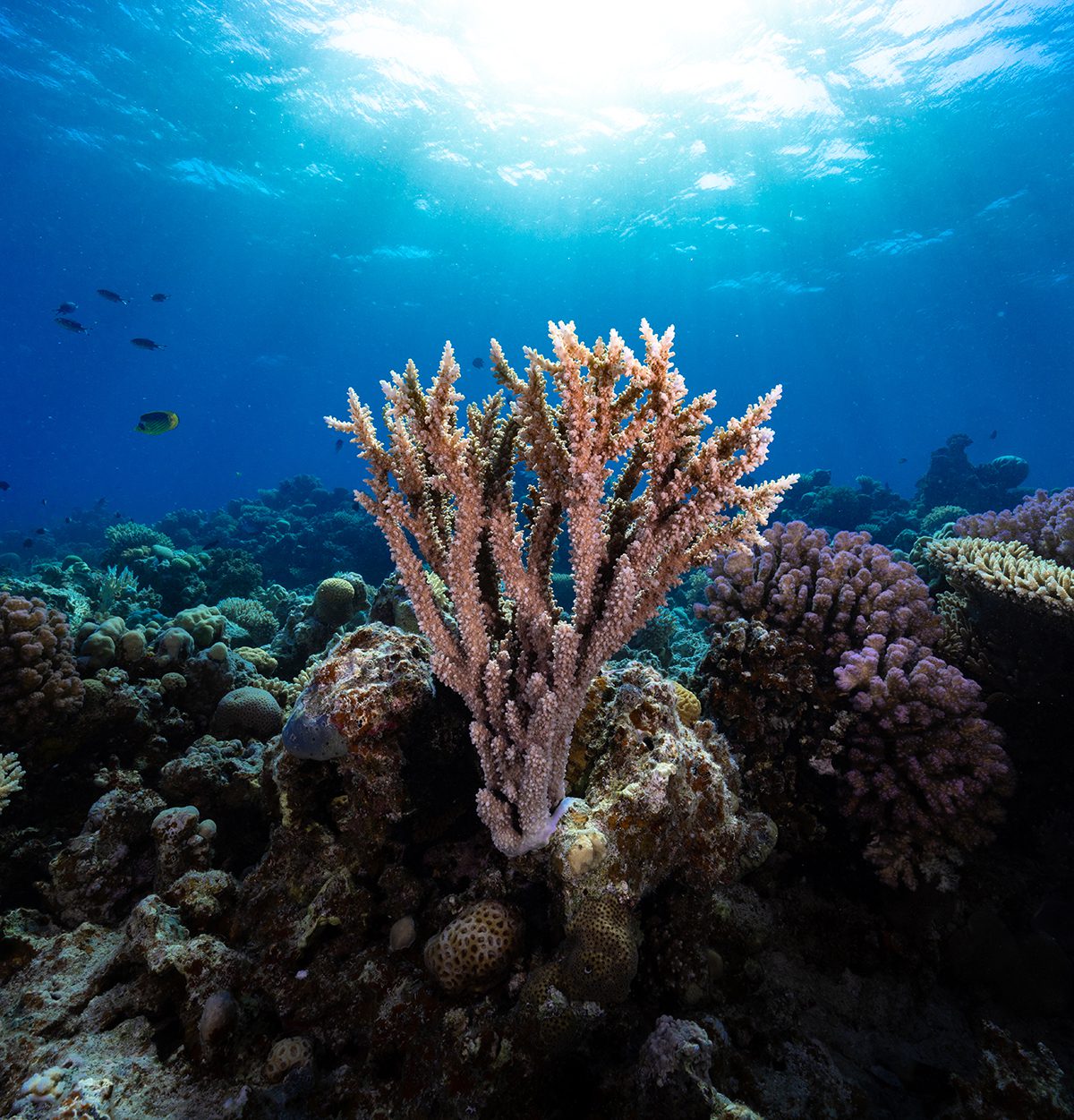

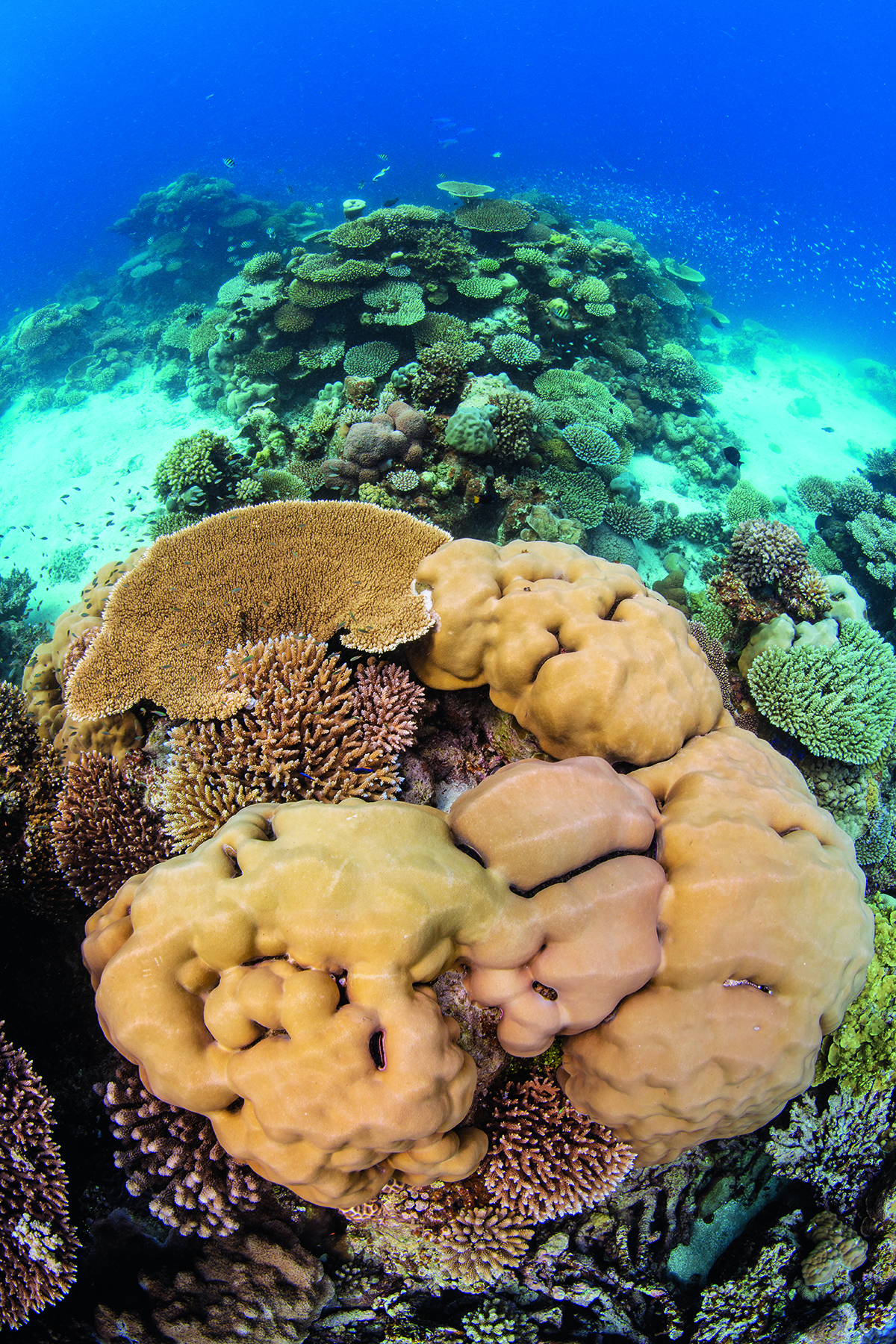

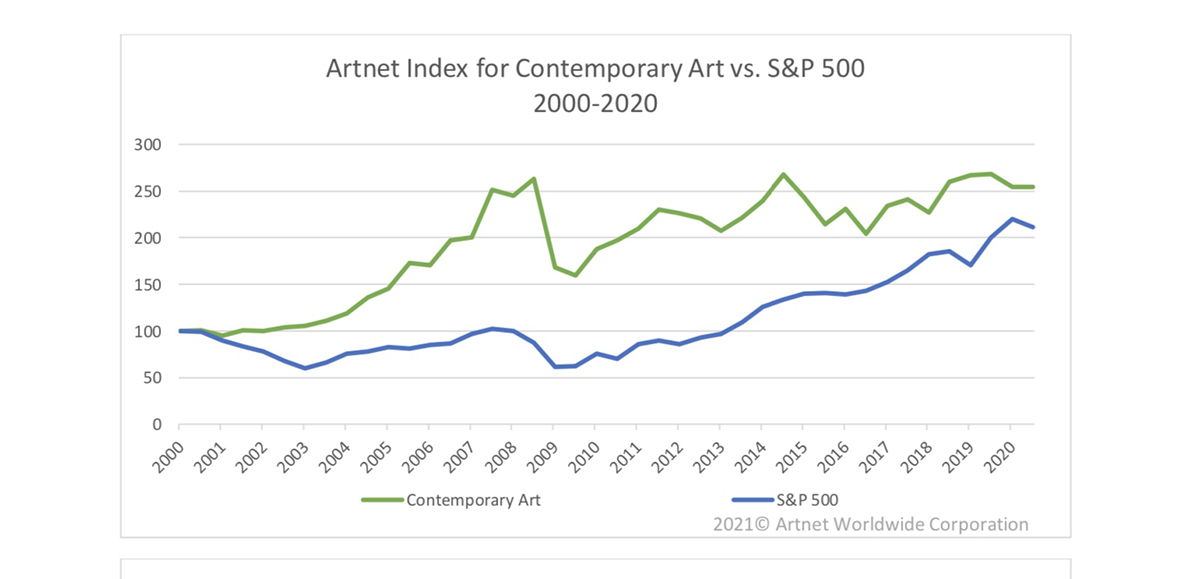

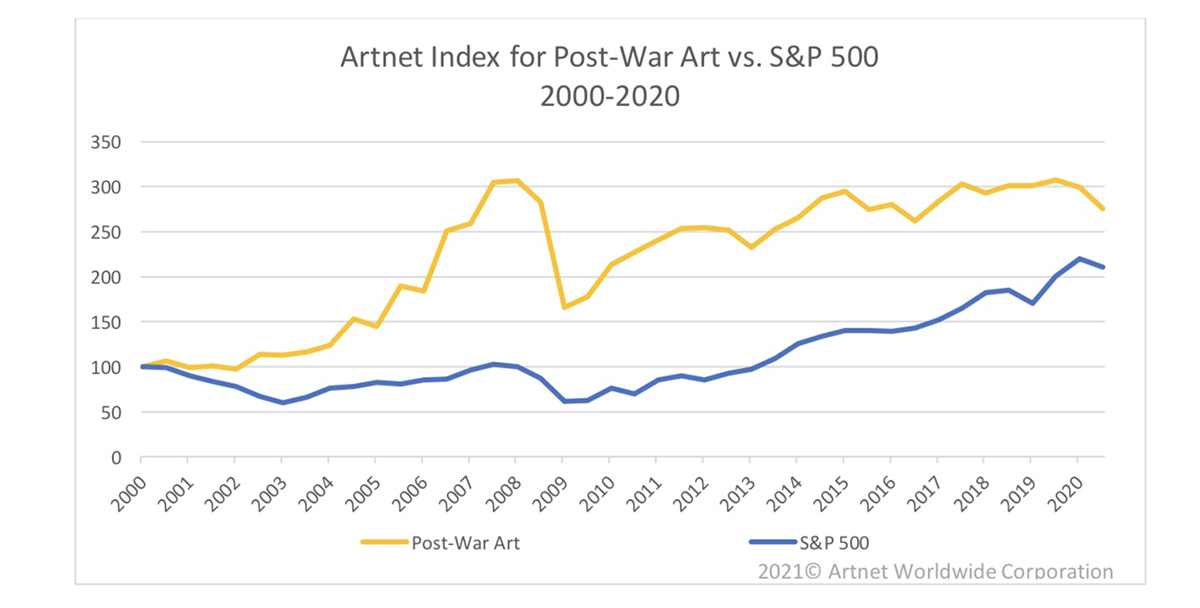

Can we put a price tag on nature? Valuing the carbon services of plants and animals is essential to bridging the gap between finance and conservation, says Professor Connel Fullenkamp, the leading academic working at the intersection of science and economics. Here, Fullenkamp speaks to LUX about the importance of engaging capital markets in biodiversity financing, and why necessity is the mother of invention

Can we put a price tag on nature? Valuing the carbon services of plants and animals is essential to bridging the gap between finance and conservation, says Professor Connel Fullenkamp, the leading academic working at the intersection of science and economics. Here, Fullenkamp speaks to LUX about the importance of engaging capital markets in biodiversity financing, and why necessity is the mother of invention

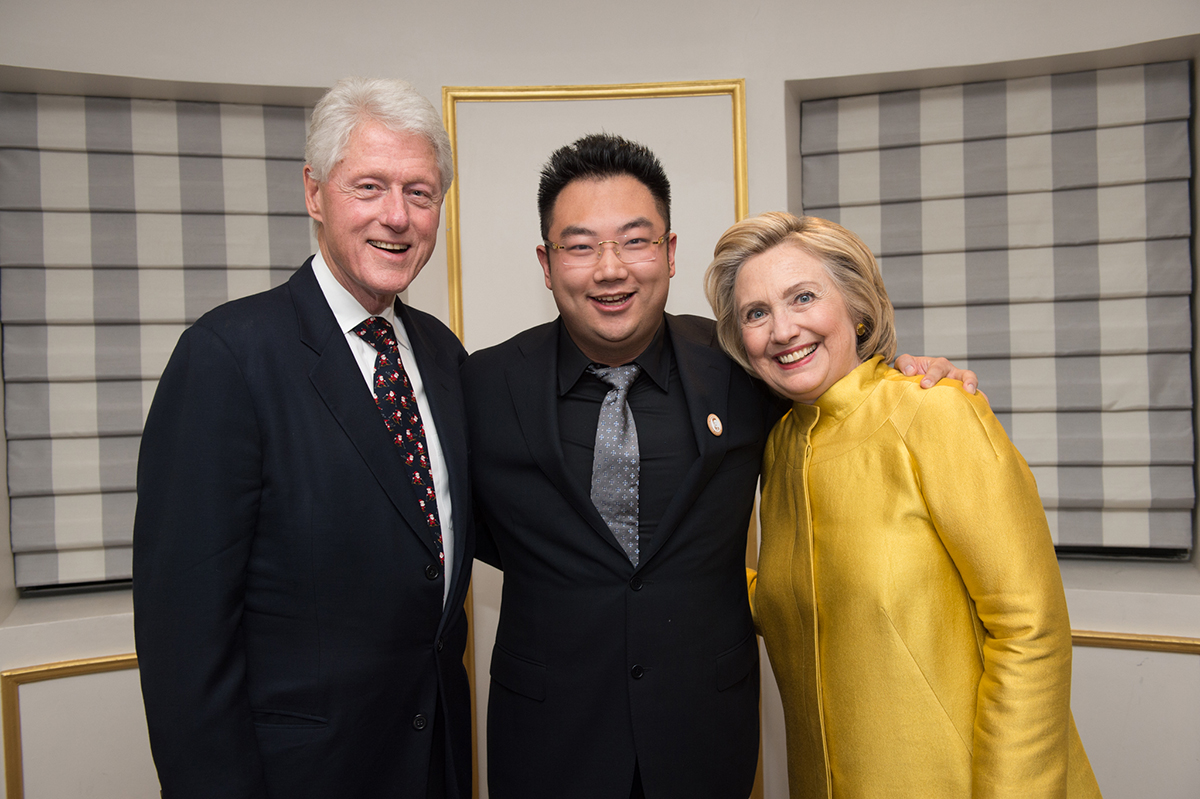

East also meets West in one of Xu’s more unusual leadership techniques – using astrology to recruit the right people. “I like horoscopes because I studied neuroscience, and my favourite part of history is Greek mythology. In the company, I know the horoscope signs for most of my people and I place them according to their strengths. Scorpios are more meticulous, for example, so they are suited to finance work, whereas Leos and Aries are more outspoken – it is easier for them to develop new markets.” What does his own star sign indicate? “I am Libra – that’s why I like balance,” he says.

East also meets West in one of Xu’s more unusual leadership techniques – using astrology to recruit the right people. “I like horoscopes because I studied neuroscience, and my favourite part of history is Greek mythology. In the company, I know the horoscope signs for most of my people and I place them according to their strengths. Scorpios are more meticulous, for example, so they are suited to finance work, whereas Leos and Aries are more outspoken – it is easier for them to develop new markets.” What does his own star sign indicate? “I am Libra – that’s why I like balance,” he says.

![FullSizeRender[1]](https://luxmagkop.files.wordpress.com/2015/11/fullsizerender1.jpg?w=300)

Recent Comments