SAJIDA Foundation is a value-driven, non-government organisation. It embodies the principle of corporate philanthropy.

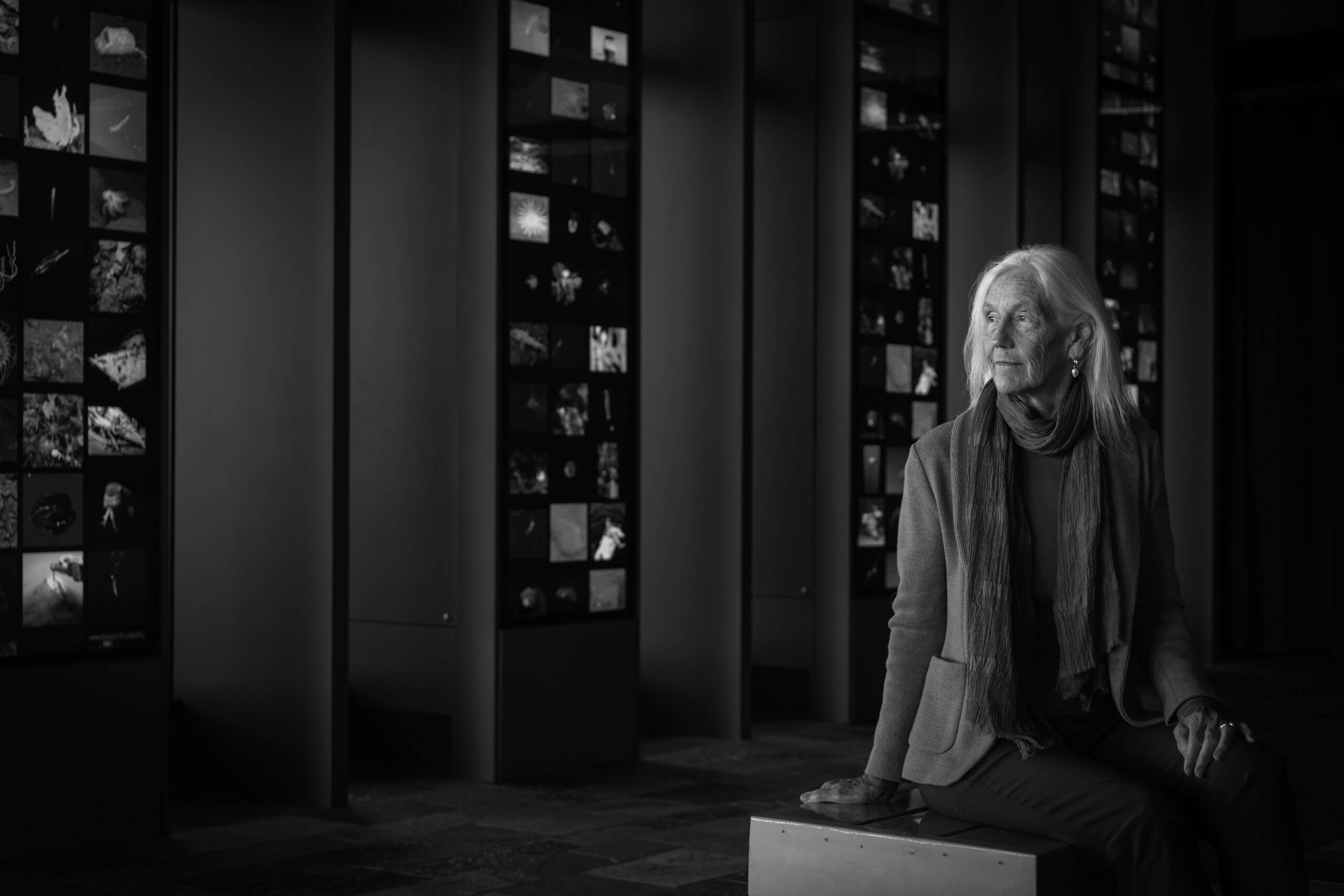

From a garage school start-up with 12 children educated for free with two meals a day, fast forward 30 years and SAJIDA’s annual budget is close to US$13 million with a microfinance portfolio of approximately US$300 million and seven independent portfolio companies. CEO Zahida Fizza Kabir speaks with LUX Leaders & Philanthropists Editor, Samantha Welsh, about relieving extreme poverty through systemic interventions in climate change resilience, women’s health and livelihood, mental health, and urban poverty.

LUX: How did SAJIDA come about?

Zahida Kabir: In 1972 my father was MD & Chairman of Pfizer Bangladesh, which in 1991 reincorporated as Renata. Renata is the fourth largest pharma company in Bangladesh. SAJIDA Foundation was the brainchild of my father, who was driven by compassion and a strong sense of duty towards the less fortunate. It started modestly in 1987 as a school for underprivileged children in my parents’ former garage.

In 1993, my father gave 51% of Renata’s shares to SAJIDA as a 25th wedding anniversary gift to my mother. I have been with SAJIDA since the start, shared my father’s vision, and helped it grow to the organisation you see today

LUX: How did you evolve your leadership role?

ZK: I have always believed in empowering women, particularly mothers; SAJIDA recognizes the pivotal role women play within the family, community, and broader social context. At SAJIDA, we advocate for the holistic empowerment of women within the context of their multifaceted roles and contributions. Bangladesh is still a country with about 32 million people living below the poverty line. Women in particular face significant barriers to recover in health and education. SAJIDA is committed to mitigating the gaps by focusing on women’s and mothers’ welfare.

The organisation, founded in 1993, aims to empower communities, catalyse entrepreneurship, build equity and establish enterprises for good with an overarching vision of ensuring health, happiness, and dignity for all.

LUX: What are SAJIDA’s standout impacts?

ZK: Thirty years on, we have representation in 36 districts impacting lives through our Development and Microfinance programmes. Microfinance Programme empowers over 700,000 participants, mostly women, to benefit from our USD 377 million portfolio.

This lifts more than 6 million individuals, or 1.5 million households, annually. At SAJIDA, we see all our work through a gender lens. How is our work benefiting women? Are we investing in the welfare of the mother?

Follow LUX on instagram @luxthemagazine

LUX: How are women’s rights reflected in SAJIDA’s governance?

ZK: SAJIDA is a family of over 6,000 employees, each contributing to drive meaningful change.We advocate strongly for our female employees at all levels when it comes to implementing safeguarding policies at in their workplace. We also advocate for female leadership at all levels.

Since founding, SAJIDA has been led by a woman. Women encounter disproportionate challenges across various domains, yet their invaluable contributions are often overlooked for short-term gains. At SAJIDA we understand that empowering women leads to exponential impact.

LUX: What are the main areas of SAJIDA’s work?

SAJIDA’s operations in Bangladesh have touched over 6 million individuals through its multi-sectoral development programmes which focus on poverty alleviation, community healthcare and climate change.

ZK: SAJIDA interventions are under two main umbrellas – healthcare (which includes Renata Ltd) and financial inclusion. Our development programmes blend both within our main themes: climate change, women’s health and livelihood, mental health and urban poverty. Our Climate Change Programme targets vulnerable communities, utilizing a Locally Led Adaptation approach.

Uttaran Programme focuses on women’s health and livelihood development striving to improve Reproductive, Maternal, Neonatal, Child, and Adolescent Health outcomes. We recognize the unique multiple challenges faced by the urban extreme poor with our SUDIN programme adopting a holistic approach encompassing economic, health, education, community mobilisation together with our Mental Health Program. Indeed, we are dedicated to advancing mental health care in Bangladesh and have one of the country’s largest multidisciplinary mental health care teams.

LUX: How is this work supported at grass roots level?

ZK: We support the health programs in a number of ways. We have a 80-bed hospital equipped with ICU, NICU and dialysis facilities; our Home & Community Care service for the elderly; Inner Circle Private bespoked suite of services for special needs and autistic children; and, most recently, Neuroscience & Psychiatric provides mental health care. My commitment is to prioritize solutions to social challenges over purely profit-driven ventures and we catalyse entrepreneurship to empower communities through our financial inclusion interventions. Our Microfinance Programme fosters economic empowerment. We have also established our Impact Investment Unit to offer investment opportunities to smaller ventures.

LUX: How do you teach women to value entrepreneurship?

ZK: SAJIDA’s Microfinance Programme prioritises women’s economic empowerment by providing collateral-free loans. Our interventions are also at point of inter-generational wealth transfer, as it is important to guide second-generation women and affluent women to make good decisions and use their resources effectively. To extend our entrepreneurial ecosystem, we collaborate with Orange Corners to launch initiatives to support innovative ideas provided the company has at least one female founder. We believe using tech is a driver to women’s effective entrepreneurship and innovation. Digitally-literate women entrepreneurs deliver 35% higher ROI compared to their male counterparts.

Read more: Leading MACAN, Indonesia’s first contemporary art museum

LUX: How is SAJIDA using tech to scale engagement with your programs?

ZK: Our goal is to be a fully-digitised organization so we have launched several mobile and web Apps to offer a range of functions and services to our beneficiaries, stakeholders and SAJIDA employees. Our Microfin360 FO collection App is a digital credit system that synchs all transaction history in real-time with a web application, allowing Field Officers to view essential daily reports such as due reports, unrealised collection reports, and loan settlements. We are developing a Digital Passbook ‘Agrani: Amar Pashbook’ to give our Microfinance Programme clients access to their financial information, facilitate communication, and offer essential services.

Our Field Force Management Platform (FFMP) is an App which automates outdoor workforces and facilitates easy monitoring of field employees in real-time with its instant notification feature. In 2022, we launched our Monitoring Module to streamline our Monitoring and Evaluation processes through a dashboard for our monitoring officers to access data, analyse, share and report on impacts from their laptops. We favour a programmatic approach over projects if we are to maximize lasting impact. And for this we need sustainable, long-term funding.

The foundation enables communities to have agency over their own development, be their own drivers for change and instill a vested interest in their own futures.

LUX: How can microfinance help communities, for example, to become climate resilient?

ZK: Bangladesh is the seventh most extreme disaster risk-prone country in the world. To build climate resilience we have to open up access to water and sanitation infrastructures. Microfinance can facilitate tailored loans and microloans for constructing rainwater harvesting systems, ensuring communities have access to clean water during the dry season, significantly improving community health and resilience. Customized financial products, including savings, credit, and insurance, which are tailored to the local context can be instrumental in supporting smallholder farmers in disaster-prone regions. Microfinance can facilitate investments in climate-resilient practices and the adoption of environment-friendly technologies by designing loans to support MSMEs to purchase environment-friendly technologies and agro-machineries. Weather-indexed insurance and bundle insurance for both crop and livestock can act as a shield against unprecedented climate events.

LUX: Where do you collaborate to scale climate resilience?

ZK: In areas where SAJIDA microfinance branches are not present, we collaborate with other Microfinance Institutions (MFIs) to reach a wider range of climate-vulnerable communities. By providing first-loss guarantees, or credit guarantees, SAJIDA facilitates the provision of zero-interest loans through partner MFIs. This strategy maximizes the impact of our resources, enabling us to extend the benefits of reduced-interest loans to a broader population, acting through intermediaries. It is important to take a collaborative approach with public and private agencies to enhance the effectiveness of microfinance interventions. Remote consultancy and weather advisory services can increase the community members’ capacity to implement resilient practices. Matched savings products where the community members can collectively save and receive matching funds from the programme and rotational savings products to facilitate savings and investment in resilient agricultural practices, can further empower these communities. The programme can also support the green skills enterprise within these communities, which are necessary for implementing and maintaining climate-resilient practices

LUX: What is the role for NGOs?

The foundation covers four thematic areas: catalysing entrepreneurship, fostering equity, community empowerment and enterprises for good.

ZK: As Bangladesh’s journey progressed, and the country graduated from an LDC to an LMIC, we, at SAJIDA also evolved our approaches accordingly. We transitioned from a service delivery mindset to a system-strengthening approach. This evolution involves enhancing existing public systems rather than operating separately. NGOs have a crucial role to play in shaping broader climate financing and sustainable development strategies at the macro level. NGOs also serve as incubators for innovation, testing, and refining models that can be scaled up and replicated across diverse contexts. However, they should engage with the public administration, private entities, and policy-making bodies from the outset so that real-world needs are aligned with broader development goals.

LUX: What is the approach to public private partnerships?

ZK: The start-up and social enterprise ecosystem is at a nascent stage in Bangladesh and many parts of Africa. To support ecosystem development, sector-specific incubation and accelerator programs need to be introduced and the deployment of blended patient capital will be critical. As mentioned, this is why SAJIDA is currently implementing the Orange Corners program, to provide heavy-touch mentorship to budding entrepreneurs to develop effective business models. SAJIDA also implements smart solutions in the areas of WASH, agriculture, and health to empower and uplift communities. I believe an empowered community will be attractive to the private sector and thus paves a pathway for mobilising additional capital.

LUX: Philanthropists talk about taking ‘baby steps’, how would you guide a philanthropist starting on their journey?

My father was a caring, compassionate and empathetic man. From a young age he was deeply troubled by the inequalities in the world around him. He wanted to solve a very complex problem, that of poverty. I believe that behind every desire to make a change is a passion to challenge and to stand up for the most neglected in society. We all have to believe that it is our responsibility to make a contribution to the betterment of our society. The size of the contribution does not matter – no amount is too small. Ask yourself this, what will be my legacy? What kind of a world do I want to see for the next generation? I urge everyone to take that leap. Take that small step to see what you can do.

Recent Comments