Works by Pia Krajewski in the group exhibition ‘Lost and Found in Paradis’, Paris, 2019

The pandemic has changed the art market forever. A new model of purchasing and enjoying art is amazing, and a new generation of collectors with different passions is coming to the fore, as our contributing editor and columnist Sophie Neuendorf outlines

Sophie Neuendorf

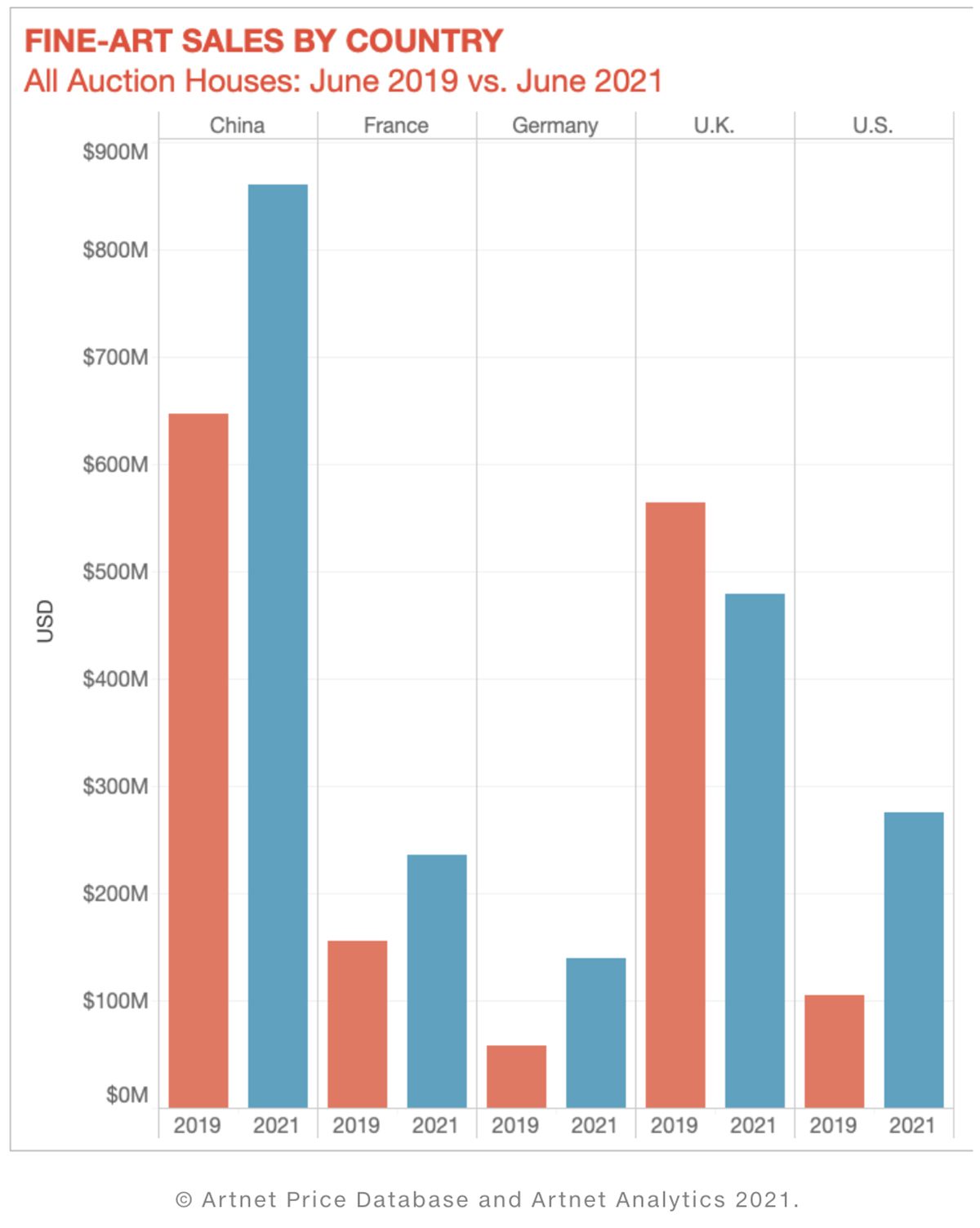

2021 is proving a year of profound shifts within the art market. Covid-19 restrictions and socio-political changes have empowered some markets, such as in Germany, and caused the decline of others, such as in the UK (see bar chart below). The most notable, even sustainable, of several changes are a shift to online transactions, a rise in new collectors and markets, and the rapid development of alternative art-related assets. Looking back, it took a pandemic to propel the art world forward 10 years within 12 months.

Follow LUX on Instagram: luxthemagazine

With the steady roll-out of vaccines and a slow return to ‘normal life’, many industry insiders and commentators are debating whether or not the art industry will return to its pre-pandemic existence, especially with regard to its former habit of jetting around the globe to see the latest fairs and exhibitions. But is that what collectors still want, and does it reflect the zeitgeist? The answer is yes and no, with recent developments pointing towards a hybrid model of transacting online and enjoying in person.

Recent data suggests that more and more collectors are confidently and regularly transacting online, with the 2021 Art Basel/UBS art market report showing that in 2020, 90 per cent of high-net-worth collectors visited the online viewing rooms of galleries and art fairs rather than their physical spaces in spite of the fact that in the same period 66 per cent of the same group expressed a preference for viewing art at a physical exhibition. For context, online-only fine art sales at the three big auction houses – Christie’s, Sotheby’s and Phillips – in 2020 jumped from approximately US$100 million to just over US$1 billion, according to artnet data.

Read more: Helga Piaget on educating the next generation

It is predicted by the research and consulting firm Cerulli that over the next 25 years more than US$68 trillion will be transferred primarily by baby boomers to their generation X heirs and to charity, with potentially a large part going to fine art and collectibles. These are the most important groups of collectors to watch. It’s also these generations who will sell part of their inherited collections and re-invest.

According to artnet data, the categories currently most favoured are modern and contemporary art, closely followed by post-war and ultra-contemporary art. Where the collectors of the baby boomer generation were knowledge- and expertise-driven and interested in the art-historical context of an artist, the new generation is often interested instead in the context of an artwork in terms of current events (such as climate change, Black Lives Matter or #MeToo), as well as what motivates and moves the artist in question. It is unsurprising, therefore, to see the rise of ultra-contemporary art, specifically the work of African American artists and female artists (see table below). This is supported by data supplied by artnet’s partnership with Artfacts, in which the combined data points (exhibitions, art fairs, auction data, among many others) help determine the popularity of emerging artists. For example, artnet/Artfacts data suggests that work by artists such as Woody de Othello, Mario Klingemann and Anne Samat will become more desirable and valuable over the near future.

A new generation of patrons, such as Eugenio and Olga de Rebaudengo, are driven by their desire to support emerging artists and help them reach their full potential and recognition. Their visionary hybrid model of online exhibitions and offline pop-up shows, developed in 2013, was ahead of their time and are now, post-pandemic, growing in popularity. “We are very lucky, because, for us, collecting and supporting artists and creating projects with them is a central part of our everyday life. We focus in particular on artists of our generation and try to get involved with them before they become mainstream names,” Olga explained, adding that, “When we believe in an artist and their vision, we love to collect them in depth and often we become good friends in the process.” Artists whose work the de Rebaudengos are collecting include Michael Armitage, Pia Krajewski, David Czupryn, Avery Singer, Sanya Kantarovsky and Josh Kline.

Read more: Milk Honey Bees Founder Ebinehita Iyere on youth work & creativity

The rise of new, young collectors goes hand in hand with the development of art-related alternative assets. Over the past few months, there has been a steady development in the tokenisation of works of fine art. This means that you can now purchase a share of an artwork and trade it, in the same way you would purchase a share on the stock market. Being much easier and faster to sell than an actual artwork, tokens are an attractive entry point into the art market and appeal to potential new buyers who are unfamiliar with it. Such buyers may find the prospect of investing into a blue-chip work daunting and find tokens as a way to slowly ease themselves into the pool of collectors. Keep an eye out for firms such as Sygnum and Ikon Exchange, who have recently launched their first tokenised works of fine art.

Olga and Eugenio de Rebaudengo with Antigone (2018) by Michael Armitage. Courtesy ARTUNER

Tokenisation of an artwork is not to be confused with non-fungible tokens (NFTs), which are growing in popularity among collectors worldwide. NFTs are unique digital assets, such as an artwork, stored on a blockchain which in turn is a system secure from cyberattack by virtue of its non-centralised presence online. According to NonFungible.com’s data, NFT sales peaked on 3 May 2021, when $102 million of NFTs changed hands in a single day with the seven-day period surrounding the peak bringing $170 million in transactions. If the numbers for the crypto-art category appear startlingly low, that’s because NonFungible.com only tracks on-chain transactions. Some of the biggest sales of crypto art – such as the Beeple digital collage that sold at Christie’s for $69.3 million of Etherium, Sotheby’s sale of Pak for $17 million, and so on – generally happen off-chain, meaning they are not recorded on the public blockchain. (This has, in turn, led some in the digital art community to question whether these are ‘real’ NFTs.)

The pandemic has ushered in an era of positive change as the art world finally embraces digitalisation. The new generation of collectors is a driving force, especially in terms of emerging artists and innovations. This increased liquidity will surely carry the upwards trajectory well into 2022 and beyond.

Sophie Neuendorf is Vice-President at artnet. Find out more: artnet.com

This article was originally published in the Autumn/Winter 2021 issue.