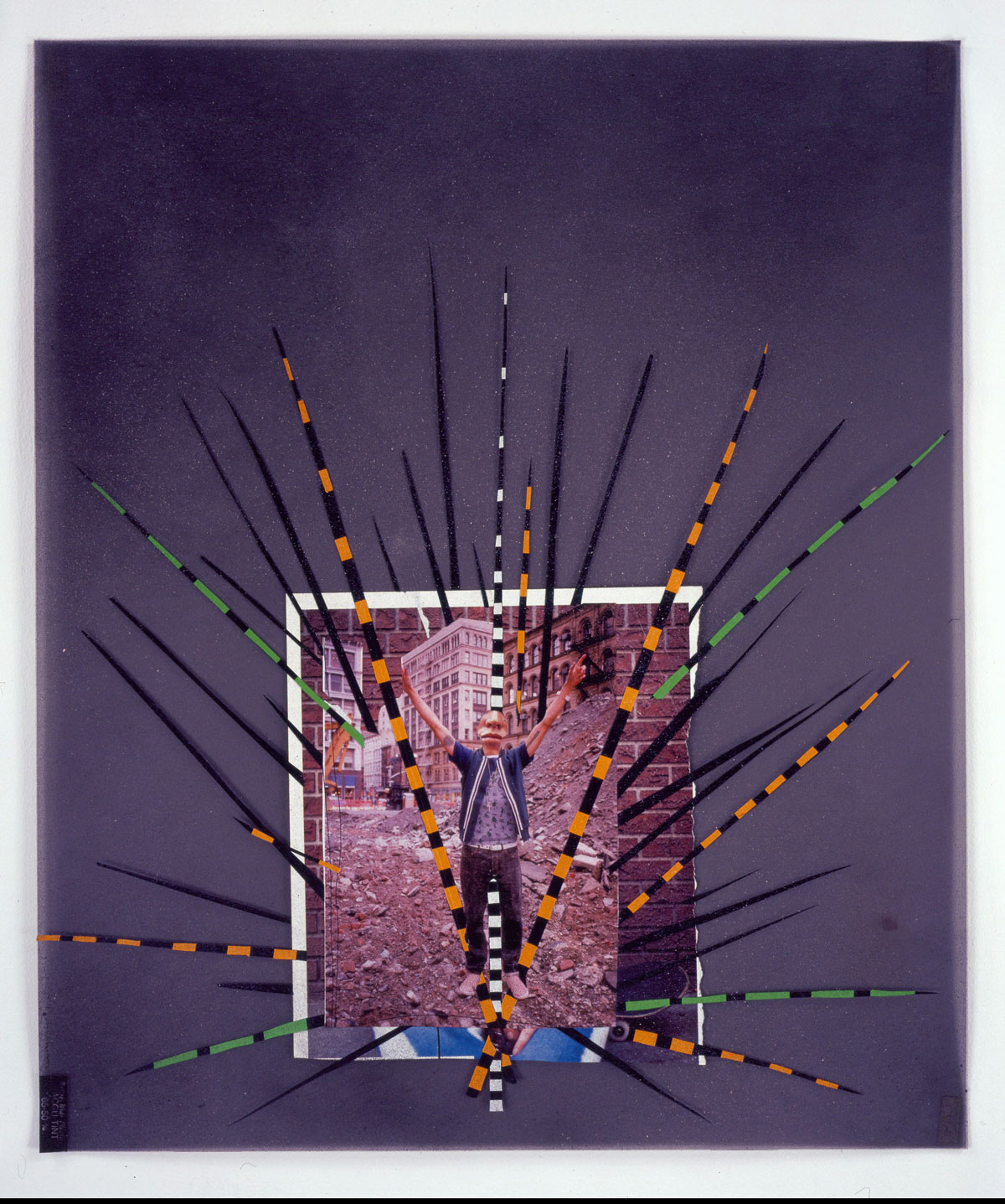

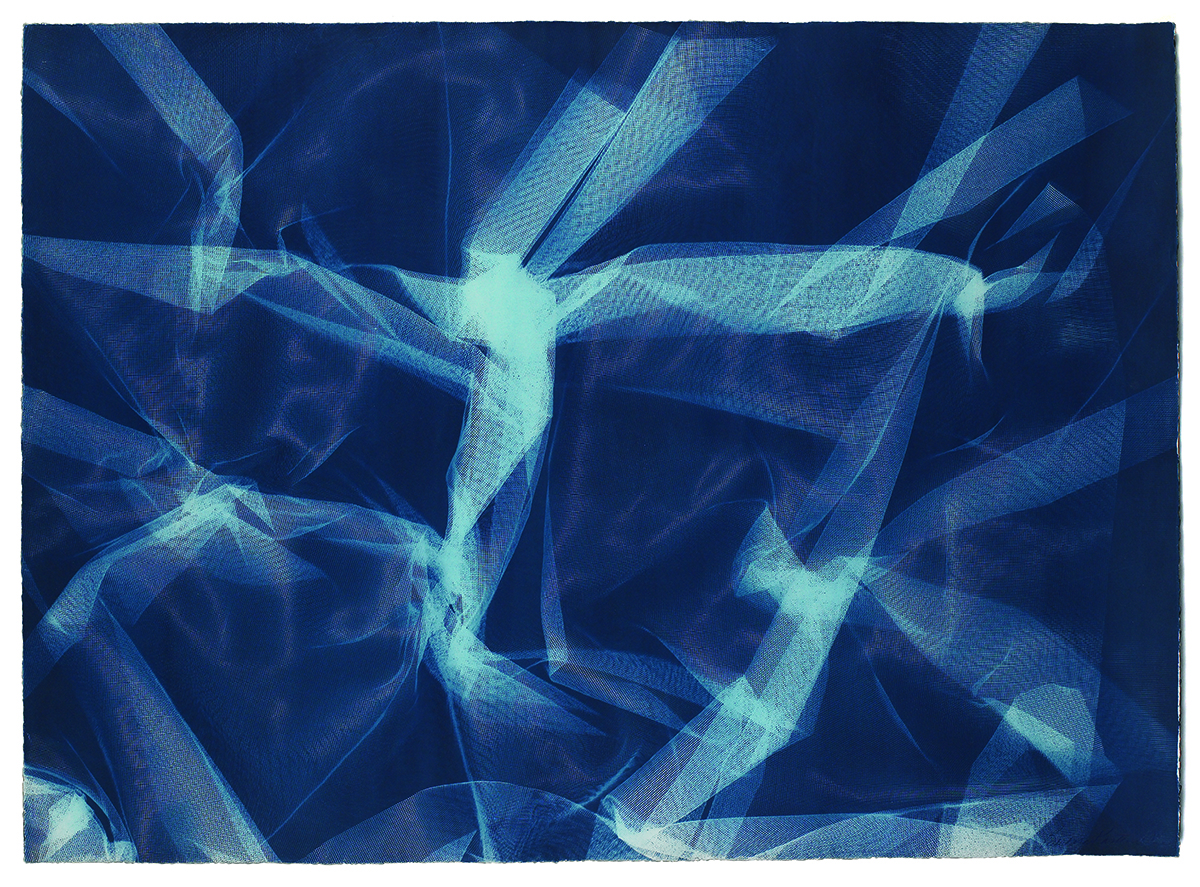

From David Eustace’s series ‘Mar a Bha’, which translates from Gaelic to ‘As It Was’

The investment community is waking up to the opportunities in our oceans. Impactful ethical investments in the blue economy can involve plastic waste prevention, sustainable seafood, maritime transport, eco-tourism and more

Photography by David Eustace

DEUTSCHE BANK WEALTH MANAGEMENT x LUX

Robert Goodwin was on a mission to solve Haiti’s cholera problem. For nine years after the island nation’s devastating 2010 earthquake, periodic cholera outbreaks started hurting communities, doing the most damage to people with limited access to clean water and sanitation. The country’s clogged water canals were to blame for spreading the disease. Goodwin, the former CEO of Executives Without Borders, started looking at why the canals were so clogged. “I’m a root-cause guy,” says Goodwin. “I knew that cholera was a water-borne disease and saw that flooding was causing all the transmission. When I looked at the canals and what was causing the flooding, I saw that it was a lot of plastic trash that could have been recycled.”

Follow LUX on Instagram: luxthemagazine

Haitian communities could recycle materials such as metal and aluminium, but there was little in the way of plastic recycling infrastructure. So, Goodwin started a business, paying local people to pick up plastic trash and then sort it by colour, weight and type. They were paid cash on the spot. Goodwin’s efforts eventually grew into a new company, OceanCycle, a New York-based social enterprise aiming to help businesses integrate ocean-bound plastics into their products and improve traceability across the supply chain. (Ocean-bound plastic is the waste from areas in close proximity to the coast, where cutting off streams of plastic before they reach the ocean is most critical.) Companies such as OceanCycle are part of the growing blue economy, which the World Bank defines as the “sustainable use of ocean resources for economic growth, improved livelihoods and jobs, while preserving the health of the ocean ecosystem”.

“We want to turn off the tap,” says Goodwin. “Once the plastic has been in the water for too long it breaks down and it’s harder to recycle. If we want to stop the flow of any new plastic into the ocean by 2030 we have to put a value on recycling ocean-bound plastic.” Consumers around the world are more interested in ridding the ocean of plastic than they have ever been. More than 90 countries have placed some kind of ban on plastic bags, straws or other single-use plastics. The Ellen MacArthur Foundation predicted in 2017 that unless things changed the ocean could contain more plastics than fish by 2050. Consumers wanting to protect the ocean are becoming an incentive to create a now fast-growing market for cleaning up ocean trash. Sportswear company Adidas has teamed up with non-profit Parley for the Oceans to sell trail-running shoes made with ocean plastic, Method makes dish-soap containers from plastic picked up on the beaches of Hawaii, and Patagonia is making jackets from yarn derived in part from fishing nets. But plastic is only part of the new blue economy.

Approximately 70 per cent of our planet is covered by water and the ocean is a critical resource providing food for three billion people around the world. Seaweeds and miniscule ocean plants known as phytoplankton provide more than half of the oxygen we breathe, according to the US National Oceanic and Atmospheric Administration. There are approximately 680 million people around the world living in low-lying ocean areas, and the blue economy, which includes tourism, fishing and shipping, generates $3 trillion of economic output each year, according to the United Nations. All told, the services provided to humanity by the oceans are valued at $24 trillion and create a value of more than $2.5 trillion each year.

Read more: Deutsche Bank’s Claudio de Sanctis on investing in the ocean

But we don’t own the oceans or pay them for their services. “The ocean is not just a provider of value. It also helps us to digest the negative results of industrialisation,” says Markus Mueller, Global Head of the Chief Investment Office at Deutsche Bank Wealth Management. “There’s also a deep human attachment to our coastal regions. The ocean gives an emotional connection,” Mueller says. “People are divers and go on vacation at the beach. They’ve seen all this plastic in the sea.”

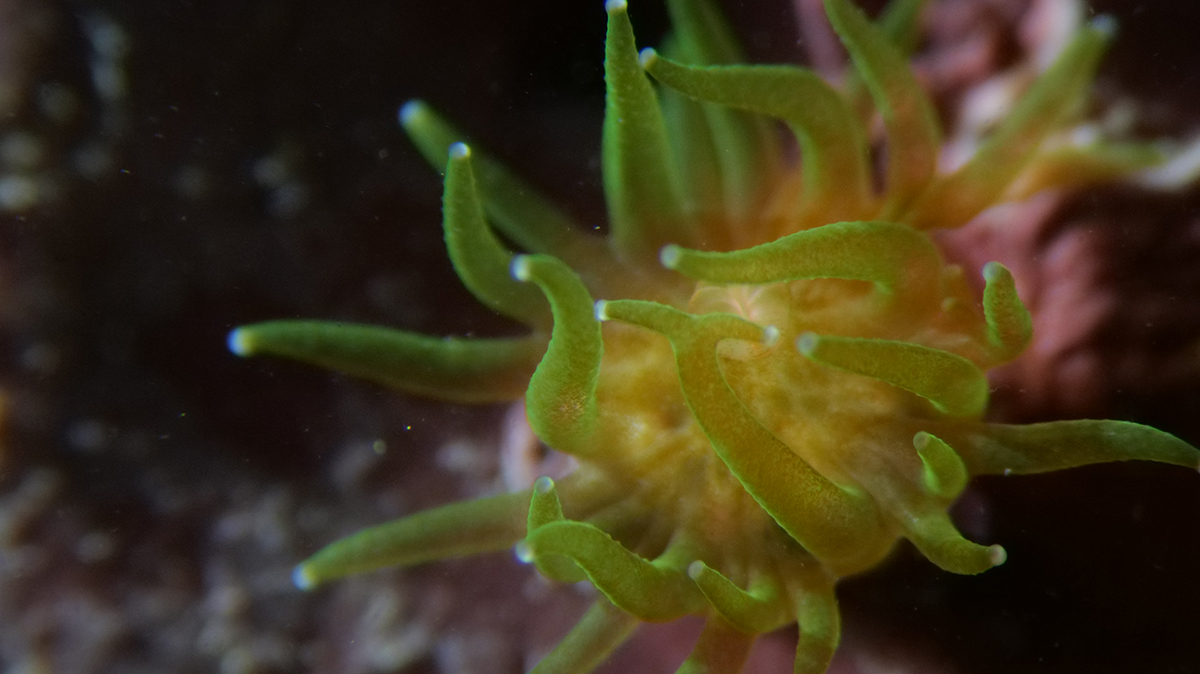

Beyond ocean plastic, the oceans have seen fish stocks depleted, coral reefs die and beaches recede as a consequence of human activity. It’s not a case of the tragedy of the commons, in which people who act in their self-interest spoil a shared resource. But, Mueller explains, the oceans “are more or less a tragedy of laissez-faire because they’re not governed. We need some governance around this to prevent tragedy and right now there is no incentive system that gives us the direction on what to do.” Some countries, including small island nations such as Seychelles, are issuing blue bonds that prioritise ocean health, and the Maldives is working to vastly reduce plastic waste. But governance is much needed.

A report published in September 2019 by the UN’s Intergovernmental Panel on Climate Change (IPCC) stated the world’s oceans are experiencing drastic changes. And these changes are not only impacting people and the planet but also placing the global economy at risk. The report highlighted the troubling changes occurring across oceans as a result of increased emissions from greenhouse gases. Oceans are absorbing 30 per cent of carbon emissions, making them a crucial resource in the fight against climate change. The report predicted that sea levels will rise by up to a metre by 2100, there will be markedly fewer fish in the oceans and stronger, more intense hurricanes will cause billions of dollars’ worth of damage.

From David Eustace’s ‘Highland Heart’ series

Investing in the blue economy is just beginning, but it’s expected to grow at a faster rate than traditional investments. In 2018, the World Bank announced PROBLUE, an umbrella multi-donor trust fund (MDTF), with the goal of supporting healthy and productive oceans. PROBLUE is part of the World Bank’s overall blue economy programme, which takes a co-ordinated approach to ensure sustainable oceans and coastal resources. Focused on four key themes, the fund was created out of client demand, and to aid the bank towards a better understanding of the current and emerging threats facing the world’s oceans.

Most investments in ocean-related assets at this stage are privately held venture-capital or private-equity firms, and opportunities reach far beyond plastic-waste prevention, to sustainable seafood, maritime transport, eco-tourism and coastal adaptation.

“Oceans have played a critical role in mitigating climate change – they have stored 93 per cent of the planet’s carbon, and produce over 50 per cent of the oxygen,” says impact investor Shally Shanker of AiiM Partners Fund, based in Palo Alto, California. “Every second breath we take comes from the oceans. Ocean ecosystems are deeply interconnected with land and air. Yet, oceans remain a very underinvested sector.”

Read more: Kering’s Marie-Claire Daveu on benefits of the blue economy

Some of the blue economy-based investments Shanker is focusing on include sustainable replacements for plastic and Styrofoam, reducing antibiotics in farmed seafood and cost-effective data collection. Since three billion people depend upon the oceans for their primary source of protein, food security and growing protein demand are other areas of her work’s focus. Sixty per cent of new seafood demand is coming from India and China – two emerging economies each with populations of more than one billion. To identify viable replacements, Shanker says she is investing in plant-based and cell-based seafood alternatives. “Most of the problems in the ocean start on land,” she says.

Redesigning humanity’s relationship with the ocean is no easy task. There’s no choice but to start taking better care of the seas, because our economy has changed them. Coral reefs worldwide, for example, continue to be ravaged by bleaching. According to the International Union for Conservation of Nature (IUCN), the Great Barrier Reef in Australia and the Northwestern Hawaiian Islands saw the worst bleaching on record for three years in a row. “The Red Sea, where I grew up, is the most luscious sea on Earth because it is the newest sea,” says Ibrahim AlHusseini, an entrepreneur and environmentalist who has founded impact investing firm FullCycle. AlHusseini, a lifelong scuba diver, became an environmental investor 15 years ago when he noticed the sea was changing. “I would go back and go scuba diving and year after year there were fewer fish, less coral, less vibrancy and more plastic,” he says. “I just remember thinking, what is the point of accumulating all of this financial success if the things that I enjoy are fading away?” He spent a year studying ‘carbon math’, ocean toxicity and climate change, before deciding to invest in companies such as Synova Power, a waste-to-energy business that can create synthetic gas from plastic waste heated to high temperatures, and then harness it for power.

The ocean’s great resources could also hold a key to the best materials of the future. Seaweed, kelp and algae production was valued as a $55 billion market in 2018, but the market could expand to $95 billion by 2025. In Amsterdam, a start-up called Seamore is turning seaweed into bacon and pasta equivalents, while biofuel producers also use it. US-based start-up Loliware is creating compostable alternatives to plastic out of seaweed. “It’s plentiful and highly regenerative and sequesters carbon 20 times faster than trees,” says Chelsea ‘Sea’ Briganti, the founder of Loliware, which is developing nine products that use seaweed instead of plastic packaging material.

Investors who want to put money to work in service of the oceans should push companies to provide better data about their impacts, and also think creatively about what they do and don’t want in their portfolios, says Mueller. “All companies thinking about using natural resources are the profiteers from it. So, transparency is a key factor – if the impact of cruise liners and shipping companies becomes more transparent, investors can adjust.” There are new rules in effect in 2020, for example, from the International Maritime Organization to prevent atmospheric pollution from ships. Shippers are investing in scrubber technology and cleaner fuel, but data for investors about the impact of the changes is lacking.

The key to sustaining the oceans in the future is to rethink how humanity extracts resources from it. “We have to protect the value the ocean is providing rather than overusing it”, Mueller says. To make the blue economy work we have to replace old business models with more sustainable ones, then we have to put a lid on it.”

Ocean Learning

As sustainable development in a blue economy develops, the first step is awareness: to think beyond the traditional extractive economy to a regenerative one. A blue economy improves biodiversity as well as food and job security for local communities, while limiting pollution and preserving the ocean’s role as a carbon sink. Here are some private organisations focused on blue economy education.

Lisbon Oceanarium

With its almost 1,800km of coastline, Portugal is using its historic relationship with the sea to show how the blue economy can aid economic growth. The Oceano Azul Foundation, led by José Soares dos Santos, is working with the Lisbon Oceanarium to teach future generations about ocean conservation and promoting the ethical values of using marine resources sustainably.

Monterey Bay Aquarium

The Monterey Bay Aquarium runs programmes on topics from cleaning up ocean plastic to how to restore the Pacific blue-fin tuna population. The aquarium, founded in the 1970s and supported by The David and Lucile Packard Foundation, has become a centre of various blue economy initiatives. Its Center for Ocean Solutions is searching for ways, such as protecting kelp forests, to fight climate change.

Musée Océanographique de Monaco

The museum, located on the Rock of Monaco, highlights hundreds of species that live in the Mediterranean. The Monaco Blue Initiative, launched by H.S.H. Prince Albert II of Monaco in 2010, is focused on marine protected areas that can help conserve unique ocean species and habitats.

Find out more: deutschewealth.com

This article originally appeared in the LUX x Deutsche Bank Wealth Management Blue Economy Special in the Summer 2020 Issue.

Recent Comments