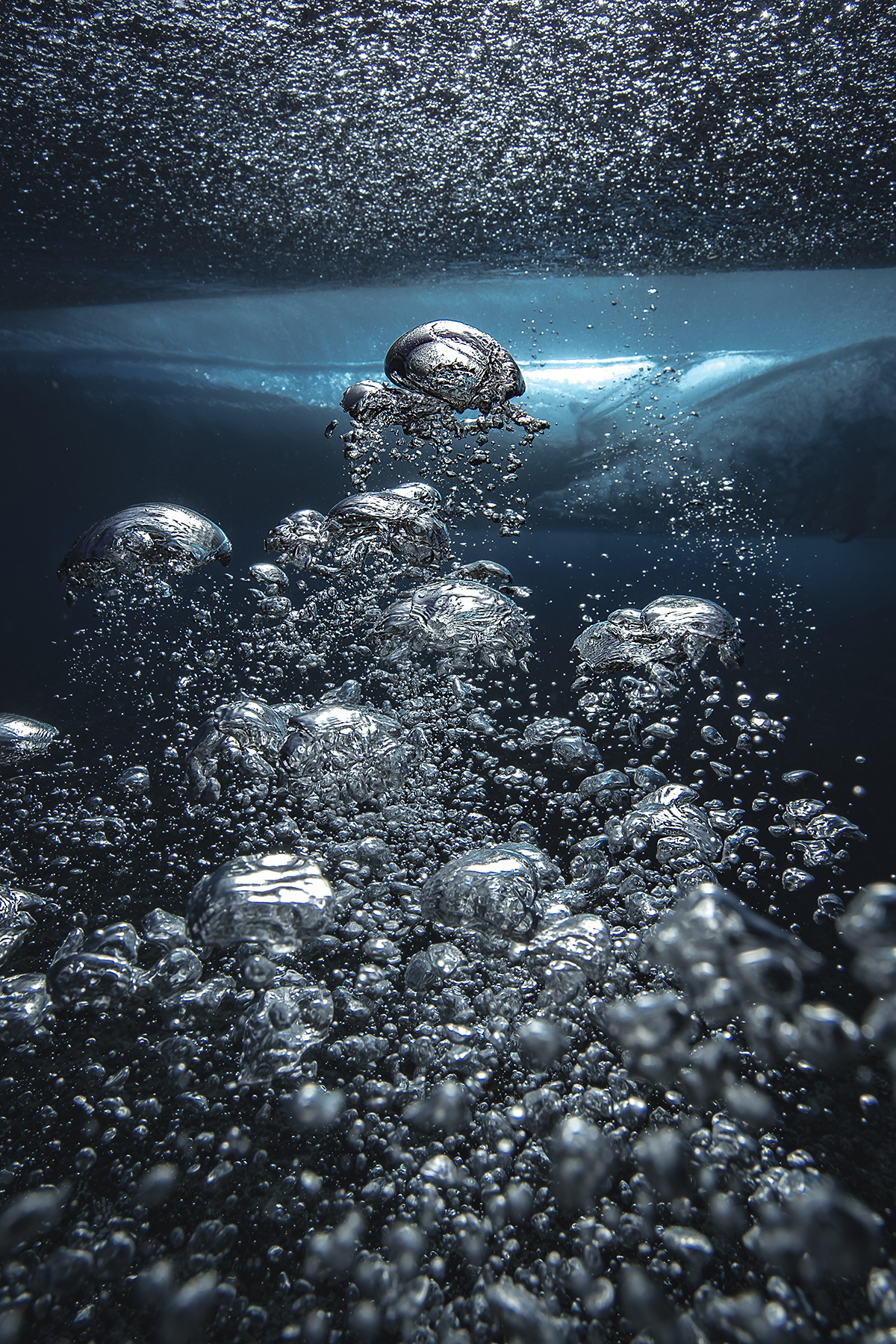

Photo by Ben Thouard

To achieve the Paris Agreement target of net zero by 2050, the world needs to shift to green infrastructure – now. In part 1 of our two-part series on making that change, Claire Asher shows how the public and private sectors can speed the move from fossil fuels to green energy

Giving up our addiction to fossil fuels will be the biggest energy transition the modern world has seen. It will require rapid changes to our energy systems and huge investments from both the public and private sectors, and it will be essential to ensure a liveable climate for generations to come.

Roberto Schaeffer

The first steps in this transition are already underway. By redesigning systems, such as heating and transportation, to use electricity rather than liquid or gas fuel, we gain the flexibility to generate that energy from a variety of sources. “Everything that can be electrified will have to be electrified,” says Roberto Schaeffer, Professor of Energy Economics at the Energy Planning Program of the Federal University of Rio de Janeiro in Brazil. Our future energy portfolio will likely include a mixture of wind, solar, hydroelectric, geothermal, biofuels and nuclear energy, tailored regionally to match local availability, as well as social and political priorities.

“Our total energy use will decline significantly as we electrify transportation and heating,” says Anthony Patt, Full Professor of Climate Policy at the Institute of Environmental Decisions (ETH) in Zurich. Nevertheless, global electricity demand will likely rise as we transition, to replace existing coal- and gas-fired power plants and to replace fossil fuels used in transportation and heating. “We’re going to need a lot of new power, a lot of investment into wind and solar,” he says.

Follow LUX on Instagram: luxthemagazine

In the short term, growing energy demands will be eased by improving efficiency. “There’s capital needed in the near term to help reduce energy wastage,” says Alice Miles, Head of Infrastructure Specialists at DWS Group asset managers. “It sounds a lot less glamorous, but there needs to be investment to upgrade to more efficient air conditioning, ventilation and refrigeration systems, better insulation and better boilers.”

Balancing Supply and Demand

Compared with fossil fuels, renewable energy sources such as wind, solar and hydroelectric provide a less consistent output that varies daily and seasonally, so matching energy supply with demand will be challenging. The most obvious solution is to store energy for later use, but installing batteries to store electricity is not cost-effective. “If you’re thinking about storing power from one season to the next, it becomes almost prohibitively expensive,” says Patt.

Anthony Patt

Scaling up battery storage will also place pressure on global supply chains. Current battery technology relies on specific minerals, such as lithium and cobalt, which are produced in only a few countries, including China, Bolivia and the Democratic Republic of the Congo. Although renewables promise increased energy independence, Schaeffer warns that, “with the energy transition, we may become even more dependent on a few countries because of the need for these materials.”

An alternative to large-scale energy storage is large-scale energy grids. “We need a grid that is bigger than our weather systems to balance out the regional differences in production,” says Patt. Weather systems alter wind speeds for days at a time, at the scale of hundreds of kilometres, so this will mean “moving from a national model of electricity planning to a more European model, and with a lot of grid interconnections,” he explains. With the right continental-scale planning and grid infrastructure in place, “you could install enough wind and solar in the right places, so that we wouldn’t have to store electricity,” adds Patt. However, this may be politically challenging.

Building a Diverse Energy Portfolio

“The number of sectors where it is cost-effective to electrify has only been increasing,” says Patt. But there are exceptions, such as the steel and chemicals industries, aviation and shipping. Alternative fuels will be needed to reach net zero in these sectors.

Biofuels, such as bioethanol or biodiesel, are one such alternative. “Biofuels can be engineered to produce exactly the kind of molecule we need for a plane or a ship, meaning that you don’t need to adapt,” Schaeffer suggests. “Similarly, some oil refineries can be adapted to also co-process biomass.” This has the further advantage of mitigating the inevitable obsolescence of existing infrastructure. However, the role of biofuels will likely be limited by competition with food crops for available fertile land and fresh water.

Synthetic fuels, produced directly from water and carbon dioxide using solar energy, could be used as an alternative to fossil fuels for sectors such as long-haul air travel and shipping. But these technologies are not yet fully mature.

A third option is hydrogen, although currently most hydrogen is produced from fossil fuels. “Really, the only sustainable option is so-called green hydrogen, which uses renewable power to split water into hydrogen and oxygen,” says Patt. This method could be used in chemicals industries that require extremely high temperatures, or as a replacement for coal in the steel industry. Elsewhere, Patt believes hydrogen’s role will be limited. “It’s going to be much more efficient to just use electricity,” he explains.

Climate Change Threat to Energy Infrastructure

Energy infrastructure was designed to withstand climate and weather conditions experienced over past centuries, but the coming decades will bring more extremes, meaning that current infrastructure will be operating outside its tolerance levels more frequently. For example, sea-level rise poses risks to coastal fossil-fuel extraction and processing infrastructure, such as oil and natural-gas platforms and refineries; increasingly frequent and severe storms can damage energy transmission lines, such as overhead electricity pylons; extreme heatwaves and drought could impact the water-based cooling systems used by coal and nuclear power plants.

Existing infrastructure may need to be adapted to cope with these extremes, and new infrastructure will need to be designed to withstand the new normal. “We have to build infrastructure that’s going to be capable of dealing with a new world,” Schaeffer explains.

There is, however, an irony in some cases. “Renewables seem to be much more vulnerable to climate change,” Schaeffer says. This is because they rely on natural processes that may be disrupted as the climate changes, such as rainfall and air currents that drive hydroelectric and wind turbines. “It is paradoxical that fossil fuels are more reliable in the face of climate change,” he adds. Changing weather patterns may reduce hydropower output, by making dry spells drier and overloading the system during the wet season. However, computer simulations by Patt and colleagues suggest that the impact of climate change on total energy output from wind and solar will be small.

Photo by Ben Thouard

Creating the Right Regulatory Environment

“From a technical point of view, the energy problem is solvable,” says Schaeffer. Renewable electricity is now the cheapest source of power in most regions, and estimates suggest that it could satisfy 65 per cent of the world’s energy needs by 2030. However, new infrastructure means large and long-term investments.

“The critical thing is to create a regulatory environment in which anybody investing in renewable-energy production knows they’ll make money,” says Patt. An example would be government incentive schemes, such as feed-in tariffs, which guarantee a fixed price per unit of renewable energy. “These remove the issue of market volatility, which has been a major impediment to new investment in the power system,” says Patt. “Solar and wind are cheap enough now that these policies don’t have to be expensive, but they are important to remove market volatility and guarantee a positive return on investment.”

Read more: Markus Müller on the links between the ocean and the economy

Recent global crises have underscored the need for a global energy transition. “There has really been a shift in mindset,” says Miles. “There were a couple of things that drove that change and crystallised the focus. The war in Ukraine was one, both in terms of the huge increase in the cost of energy, but also energy security, particularly in Europe; COVID-19 was the other.”

With increases in oil and gas prices, disruptions to global supply chains, concerns about energy security and the impacts of climate change becoming increasingly visible, more businesses and investors understand that the energy transition is not only needed, but presents a valuable opportunity. “In the EU alone, it’s estimated that the green transition will cost €350bn, of which €250bn will need to come from non-government sources,” explains Miles. “Investors increasingly recognise the opportunity to support the energy transition while generating an attractive return.”

How to scale up to net zero

To achieve the Paris Agreement target of reaching net-zero carbon emissions by 2050, green-energy solutions not only need to happen, but need to scale up fast. This urgency presents opportunities for investors hoping to support the energy transition and see a positive return on their investment. “I think private capital will play a huge role in taking businesses with proven business models and proven technology, but which need scale, to the next level of growth,” says Alice Miles, Head of Infrastructure Specialists at DWS Group. “Without scale, a lot of these initiatives are just a drop in the ocean.”

Alice Miles

The infrastructure for generating renewable energy, such as wind and solar, tends to have high initial investment costs, but relatively low operating and maintenance costs. Once operational, renewables projects can sometimes provide investors with stable revenue that is relatively sheltered from price volatilities. For example, power purchase agreements (PPAs) between electricity generators and consumers such as utility companies, set a fixed price per unit of electricity over a multi-year time frame, offering stability and de-risking revenues for the generators. However, in other scenarios, investors may be exposed to energy price volatility without recourse to protect themselves.

“There’s a virtuous relationship here, because there are investors with capital to deploy who want to see a good return, and then there are companies with proven technologies that need to scale,” says Miles. “Both of those parties can win – and we can all win – by finding the right way to route capital to the companies that can make an enormous contribution to the energy transition story.”

This article was first published in the Deustche Bank Supplement in the Spring/Summer 2023 issue of LUX

Recent Comments