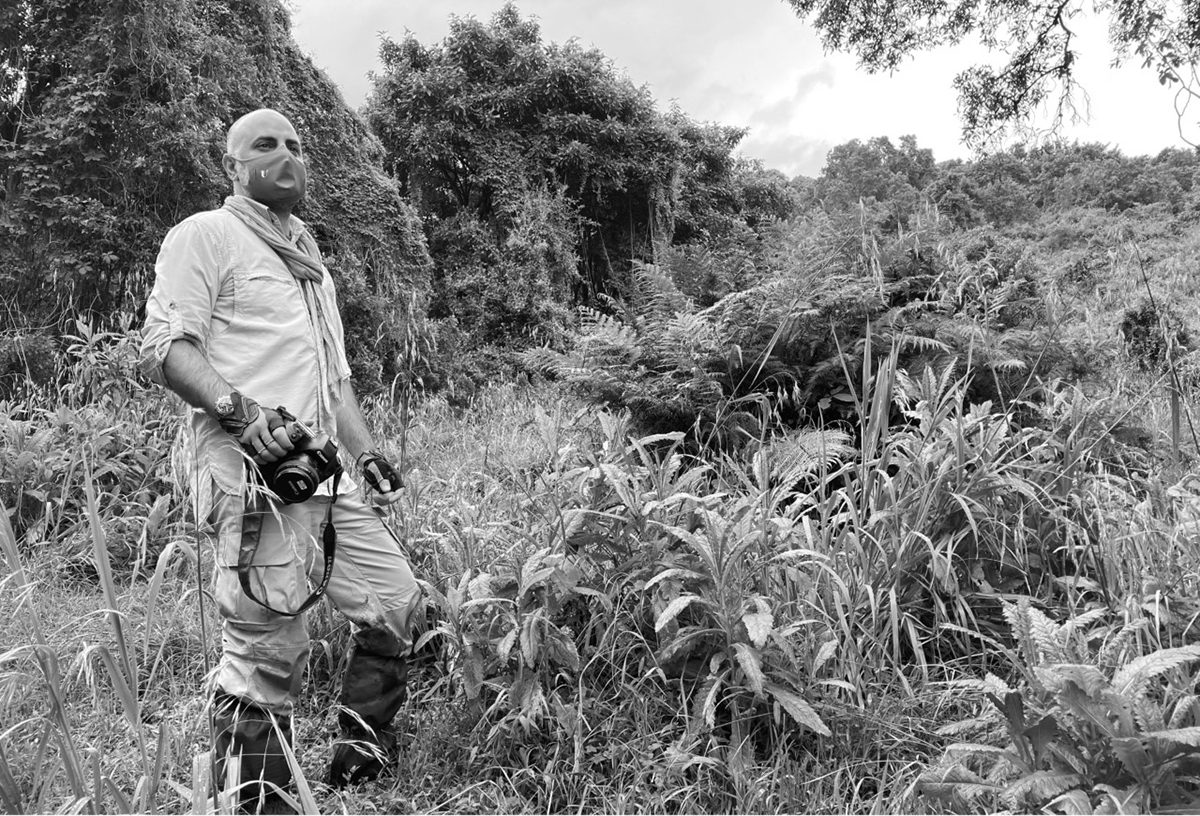

London Technology Club lunch with Alexandre Mars at The Arts Club

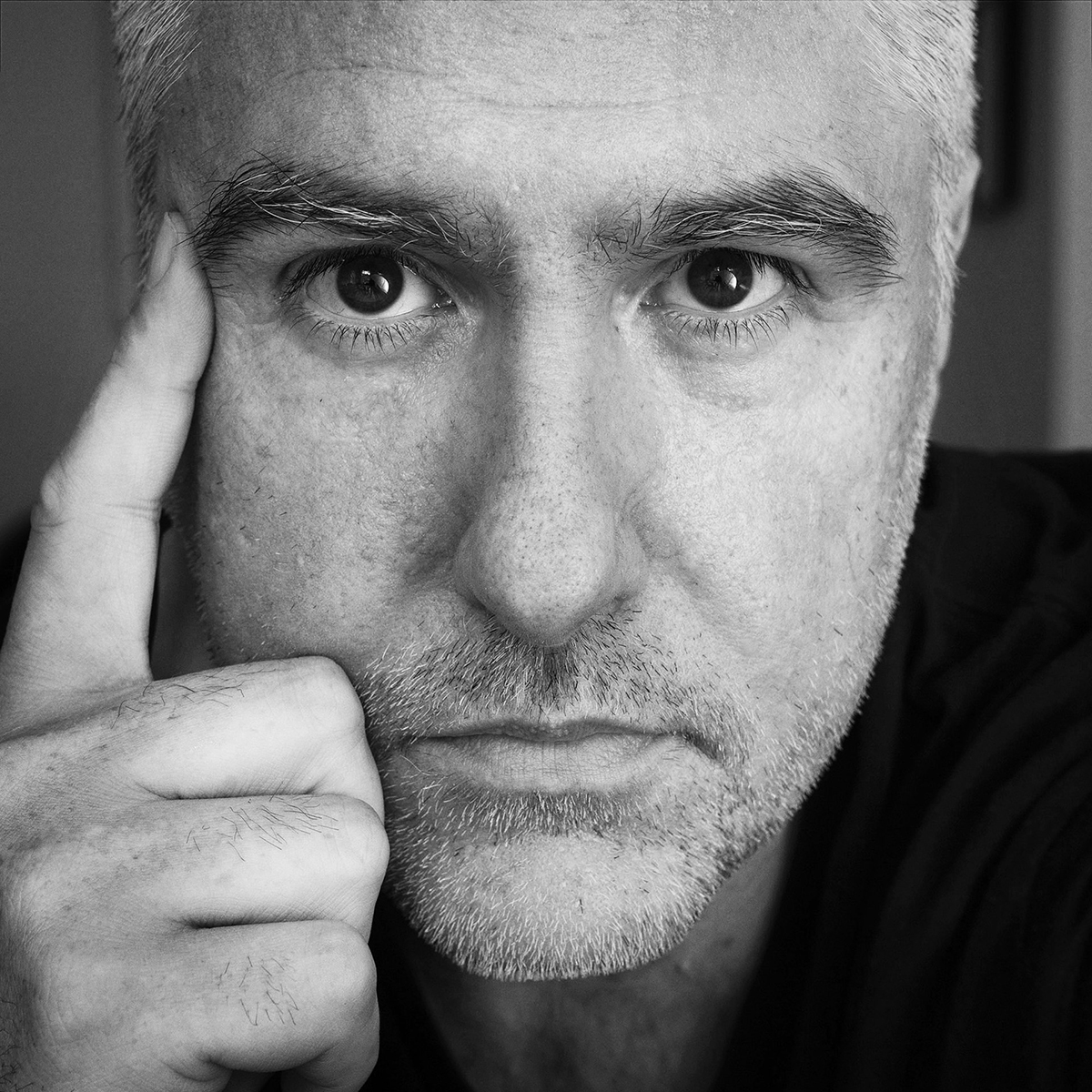

Konstantin Sidorov founded the London Technology Club to create a space for investors and tech professionals to network and exchange ideas within the industry. Here he speaks to Samantha Welsh about the benefits of bringing like-minded individuals together to establish trusted relationships.

Konstantin Sidorov

LUX: What is your opinion on the valuation of tech companies right now?

KS: It is useless to discuss the overall tech market valuation in general – many people have different opinions. Some companies look too expensive, some fairly reasonable. It is worth looking at the valuation of a particular company. And our task as a club is to provide our expertise and opinion to our members regarding the company valuation and potential value growth.

We have always reinforced the need to exercise discipline as a tech investor. At LTC, we examine both the prospects and tech moat of a company – but also the deal terms of an investment opportunity. We source our opportunities from world-class VCs that are often lead investors in a round, and therefore there is conviction from them in terms of the company and its technology.

LUX: Why did you create the London Technology Club?

Konstantin Sidorov: Venture capital is an access class not an asset class, and, when I first moved to London, I found that getting access to the best tech investment deals was all about trusted relationships. I saw that London was the capital of the world for clubs – for wine, automobiles and art – but there was no club to bring together like-minded people passionate about tech investing. So, I turned an initial idea into a sophisticated community of tech investors to have access to the best tech deals. By working with our VC partners, we are able to provide curated, high-quality level of deal flow for our members.

London Technology Club event in Dubai

LUX: Can you tell us about your preferred fund structure and your approach to diversification?

KS: Our trademark fund is the LTC Pledge Fund: a segregated portfolio fund that raises once a year. We diversify through a mix of directs (80%) and funds (20%), and in terms of verticals – from AI to mobility, and impact to fintech. We are also diversified in terms of geography; while a slight majority of our investments go to US, we are also spread across Europe, Asia and MENA. Given the sort of ticket size required for the best growth stage opportunities, by creating our fund we provide access that the limited partnerss would be less able to access on their own.

LUX: You started Pledge Fund I in 2020 and Pledge Fund II in 2021. What have your case studies shown to be your sweet spot – and how are you achieving those internal rates of return (IRR)?

KS: Since the start of Pledge Fund I we have had five exits and they were built off the back of my personal investment exits – such as Airbnb and Spotify. We were able to return 30% of capital of Pledge Fund I back to investors within 20 months with IRR above 86%.

Our sweet spot is companies with a valuation of $100m – $1bn, with proven revenues and growth. Our five exits to date reinforce our strategic approach where we balance risk and reward.

Follow LUX on Instagram: luxthemagazine

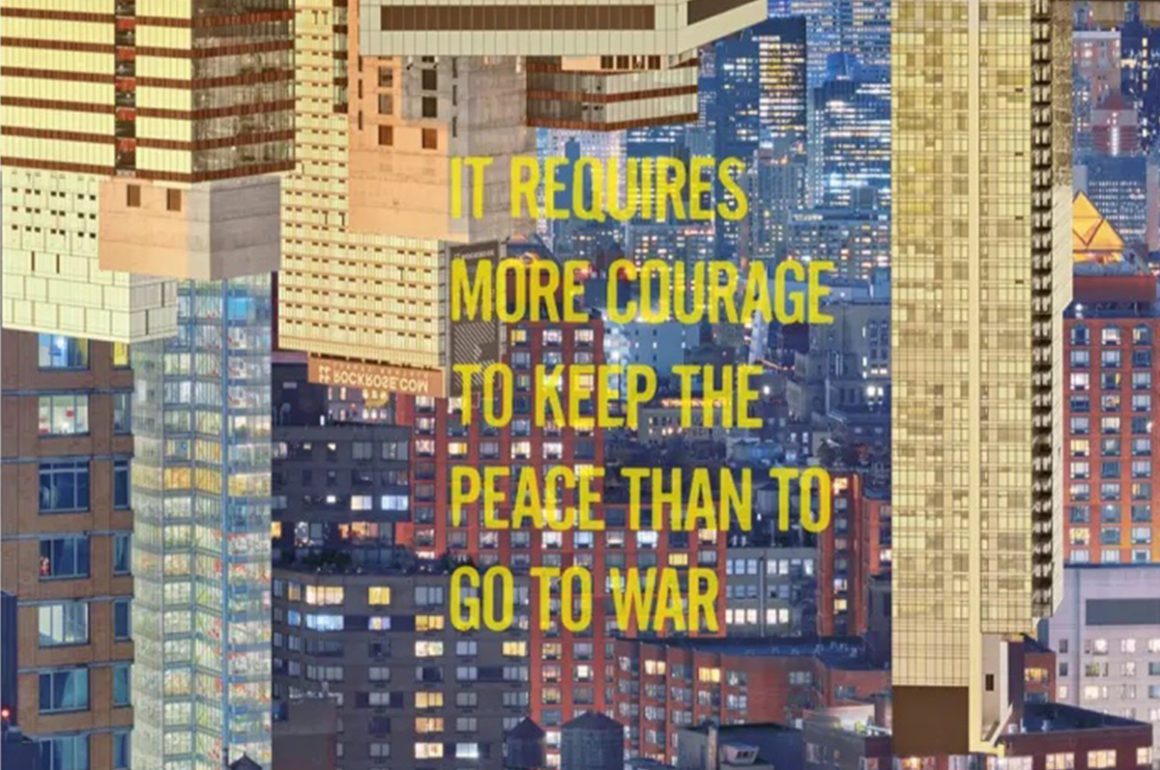

LUX: How have you seen ESG emerge during your career, and how do you see it developing from here?

KS: We are incredibly proud of our Future Technology Series reports; we’ve published over 13 in three years. They explore how technology will impact areas that our members are passionate about – from space to art, F1 to longevity, and finance to property.

ESG was one of our recent reports. For me, what has changed is people’s realisation that companies can’t just be focused on shareholder returns. We are part of an interconnected system and have a duty to both people and the planet.

London Technology Club breakfast with UBS Chief Economist Paul Donovan at the Royal Automobile Club

While everyone should be looking at ESG as business hygiene for their own companies, it is also important to consider how ESG is integrated into investments. There is some way to go, especially within venture capital. Many companies are early on in their ESG journey which we see as a good opportunity to ensure they instill ESG into their business processes. We firmly believe there is a strong correlation between companies that have strong ESG fundamentals in place and investment success.

LUX: Where do you see the role for tech in ‘slow’ industries where rarity, heritage and craftsmanship are the inherent values?

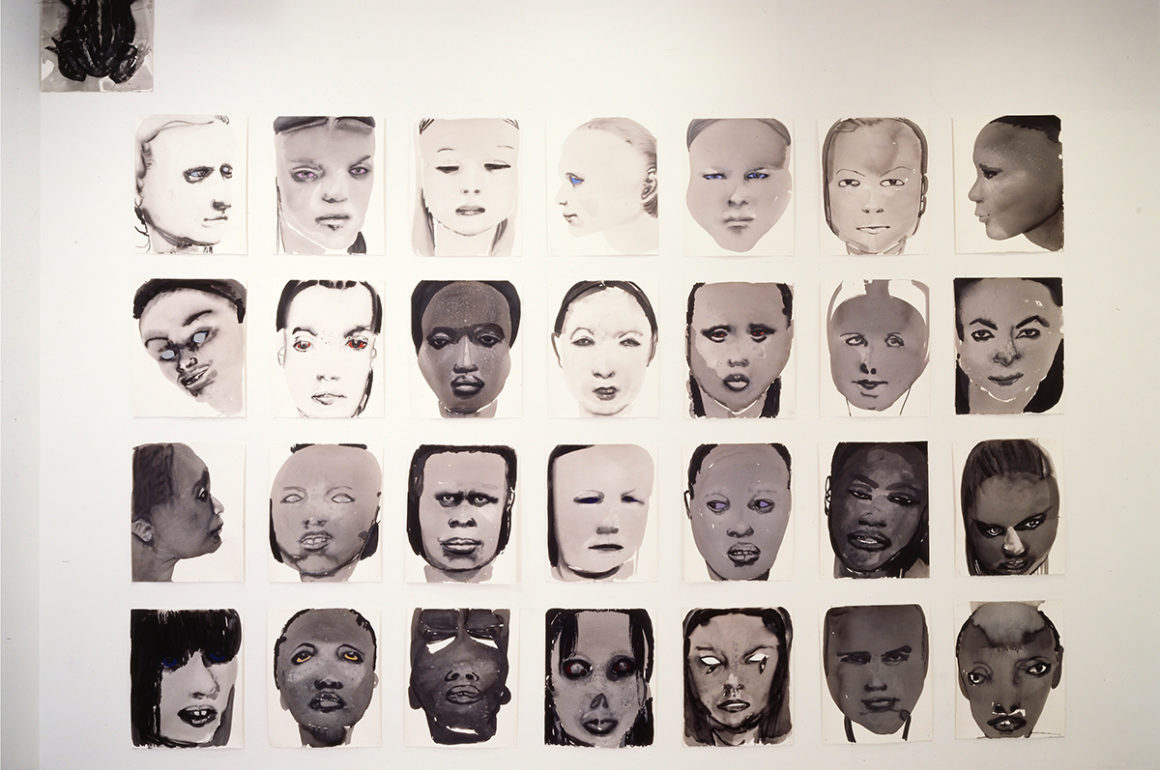

KS: We have written reports about the impact of tech on fine wine, art and fashion. From our research, we have seen a move towards the ‘creator economy’ where a craftsman or woman creates and ‘mints’ their product (i.e creates a digital asset as part of the process).

Read more: Volta’s Kamiar Maleki On Supporting New Artistic Talent

NFTs are an example of that currently. Fine wine makers could, for example, by creating digital tokens to accompany their bottles, ensure that they can track the onward sales, opening, value and storage.

This tracking ability means that the creator benefits from smart contracts that dictate that every time that bottle is sold on, the creator receives a percentage commission. It means that the creator, rightly so, reaps more reward from their creation. Tech is at the centre of progress for luxury and collectibles and I would recommend our reports to readers.

London Technology Club Super Tuscan Wine Tasting

LUX: How are you personally leading the deployment of tech to explore solutions to problems in the real world?

KS: For tech to be effective and generate returns it must solve real world problems. We are very interested in climate-first technology and have invested in numerous foodtech companies that are looking to solve challenges on food security, waste, cultivated meats and reduce environmental impacts. We have invested in companies that seek to reduce the cost of transport and improve mobility. We are big believers in tech as a force for good and so hope that our club creates the right environment for investors to be able to deploy their capital for returns that also have a positive impact on societies. As LTC’s General Partner I lead from the front to create such environments.

LUX: At LUX, we share your love of Ornellaia and Sassicaia .. please tell us about how this passion came about?

KS: We are a club known for our regular live events in Mayfair, so when lockdown came we moved quickly to gather the community online. Being based above 67 Pall Mall, the amazing wine club in London, we were able to arrange distribution for wine to be sent out to members. We would do group Zoom calls where we tasted Super Tuscans while discussing tech investments. Both Simon, our COO, and I have a love for Italian wine so it was an easy one to agree internally to do, and it reiterates our mission as a club to provide the best technology investment opportunities, discussion and experiences.

Find out more: londontechnologyclub.com

Recent Comments