Louis Vuitton’s strategy to overcome consumer inertia is to develop products, such as this from their 2017 pre-fall collection, which stand out as one-offs

The nature of luxury is evolving fast. Producers and consumers should wise up to the emerging multi-level landscape and never forget the power of the right kind of celebrity, says our columnist Luca Solca

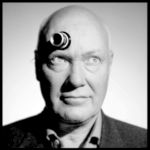

Luca Solca

True luxury is about projecting the impression, or even the illusion, of exclusivity. That is what luxury is about. If you can do that from an accessible price point and if you can do it at a very high standard, that is good enough to be true luxury. What it takes to maintain this perception of exclusivity is interesting, because nothing in the modern luxury industry is really exclusive. If it were exclusive, it wouldn’t be an industry. We are talking about businesses that have to grow fast, and growth is the exact opposite of exclusivity. And true luxury is very subjective. True luxury for Bill Gates is buying a set of Leonardo da Vinci drawings, true luxury for middle class consumers is buying a Hermès handbag – there are a million shades of difference between one definition and the other.

Follow LUX on Instagram: the.official.lux.magazine

This is what I have previously referred to as the megabrand bathtub: we have a big bathtub and the tub is producing new consumers coming into the megabrand market. New consumers, especially if they are rich, stay in the megabrand bathtub to the point that they realise that middle-class consumers buy the same brands that they do. Then they either trade up within those brands, or they trade up to more expensive brands that they perceive to be more exclusive.

This is also going to be compounded by what I call the category spend shift in which rich new consumers will go through various categories and at some point, they will have so many products in their wardrobes that they will start spending money on something else. Which leads to the discussion about experiences – going on exclusive holidays and sending their kids to universities in England or colleges in Switzerland, buying second homes and holiday houses and then buying planes to reach them.

Louis Vuitton Autumn/Winter 2017

I think as consumers get closer to what an established rich person does and is, then they tend to spend less on luxury goods products, not more. There is a fundamental misunderstanding that luxury is for the rich. Luxury goods products are for people who get richer. They go through a time when they splurge and they have to buy their products necessary to fill their wardrobes and then they go into replacement mode. I think that many Chinese consumers, many of whom were early adopters, have now moved into replacement mode already. The reason why we are all talking about the shift from gold to steel in watches, and lower entry price points, is because luxury goods today are predominantly relevant for middle-class consumers. The bulk of the new growth is coming from middle-class consumers who may have a lot of ambition and desire but only limited spending power. They buy cheaper and less exclusive products than their earlier peers. The consumption of luxury goods does always penetrate down a market from the top, though. You start with the richest consumers, then you work your way down to the middle class, which is where we are today in China.

Read next: President of LVMH watch brands Jean-Claude Biver on luxury’s new culture

At the top, there is a small number of people who need to have very special services and products specifically for them. And new consumers have upped their learning curve. They buy more frequently than established consumers and therefore their experience grows faster. New consumers also have more sources to learn about their purchases, via social media and the internet, than used to be the case. Far from being a market where consumers are just shifting to high-end brands, which was the case three to four years ago, in today’s market even if you are in the high end, you are doomed if you stay static. If you just sell iconic products, consumers who have been in the market for a while will have already bought them. They will only part with their money if you give them something that they don’t have. That’s why there has been a race to replace directors; and why Gucci has totally thrown away the past and moved on to new aesthetics, taking a huge risk, which is proving successful. And this is why Louis Vuitton, by the way, is successful – because it developed cleverly isolated ‘in your face’ products that have infiltrated the market with capsule collections.

Recent Comments