A government crackdown on conspicuous consumption may have slowed China’s luxury market, but opportunities still abound at the top end of the market. CASEY HALL investigates where China’s most wealthy will be spending their money in 2014

There’s little doubt that China’s luxury goods market has slowed from its boom years of double-digit growth, in fact, growth has slowed to a crawl. According to data from Bain & Company, Mainland China’s luxury goods market has slowed from seven per cent growth in 2012 to around two per cent in 2013, with expectations of similarly slow growth in 2014.

The Chinese government’s recent crackdown on corruption and conspicuous consumption, led by President Xi Jinping, has been one highly publicised reason for this slowdown, but it’s not the only factor. In recent years, the number of wealthy Chinese travelling overseas has grown exponentially, as international travel increasingly becomes a symbol of status and visa restrictions for Chinese travellers are eased. Worldwide, Chinese nationals remain the biggest luxury buyers, with purchases that make up 29 per cent of the global market, a four percentage point increase versus last year.

Not only are luxury goods more affordable overseas (in many cases around 40 per cent cheaper, thanks to China’s VAT tariffs for imported luxury goods sold on the mainland), they also come with the added cache of being purchased in exotic locales. According to China watchers, if there is a single desire that unites wealthy Chinese consumers desire, it is a need for newness – the next big thing, whether it be a product or experience, which will impress their friends. It’s all very well to hit up European capitals and American centers of commerce, but increasingly, just seeing the sights on a generic guided tour is not enough for Chinese travellers.

Filling the gap for a niche market at the pointy end of the pyramid are a number of experiential travel agencies organising ever more elaborate experiences for Chinese travellers. Whether they desire a round of golf with Tiger Woods, or even a trip into space, it seems the sky is the limit for big spending Chinese travellers.

Michael MacRitchie is the founder of MGI Entertainment, an agency that specialises in bringing celebrities from the East and the West together with brands from both sides of the Western/Chinese divide. They have recently launched an ‘Ultimate Experiences’ division, which organises all-encompassing travel experiences, often involving the opportunity to rub shoulders with celebrities.

“This is a niche market, the reason we came up with this is that we saw more and more Chinese people who were interested in this niche travel market and we have some key relationships in place which allow us to do these types of things, and it sort of complements our main business, which is working with celebs,” MacRitchie explained. For example, Ultimate Experiences organises trips to the Cannes Film Festival (available to a maximum of 10 travellers), which include a private concierge, tickets to premieres, entry to after-parties and an invitation to an event on Hollywood über-producer Harvey Weinstein’s yacht, followed by a helicopter ride to the Monaco Grand Prix – all for the bargain price of USD 30,000 per person.

“Chinese people want the best of everything around. They want to drink Château Lafite Rothschild; they want to go to the most prestigious events around the world. They have money to burn and want to do stuff they weren’t able to do previously. Part of it is face, part of it is showing off, and part of it is about experiencing something different,” MacRitchie said.

As international travel becomes the norm for wealthy Chinese, they are increasingly acquiring the habits of the wealthy worldwide, including sunning themselves by beautiful beaches and carving up powdery white slopes.

The new lifestyle development by KOP Properties will offer year round winter activities, including the world’s longest indoor ski trail

A reflection of this latter desire is a new development from Singaporean real estate company, KOP Properties. Winterland Shanghai will be housed within an 18-hectare development that will include the world’s longest indoor ski trail. A new generation of ski bunnies from Shanghai and around China will have year-round access to winter sports activities, ice sculpture competitions and more, including a ski-in / ski-out hotel, gardens, retail, food and beverage, as well as an entertainment center with a 4-D theatre offering movies, theatrical shows and concerts.

“Our Winterland Shanghai project represents the next landmark in lifestyle-focused developments and furthers our mission of spearheading breakthrough ideas from conceptualisation through building and management,” said KOP Properties Chairman Chih Ching. “We believe Winterland Shanghai can serve as a magnet for Shanghai tourism and Shanghai itself is a perfect city in terms of size, scale and its level of development. We are excited to bring this to the city of Shanghai.”

Real estate developers looking to capitalise on the developing leisure pursuits of wealthy Chinese are not the only ones being lured to the Mainland. Thanks to big spending Chinese collectors who have been making their presence felt in the international art highworld for the better part of a decade, big auction houses are now heading to mainland China.

In 2011, China overtook the US as the world’s largest art market as wealthy new buyers paid top prices for works from Ming vases to contemporary Chinese paintings. Michael Plummer, a New York-based art market financial analyst, told Chinese media early in 2013 that new collectors in China were buying “recklessly”, to snap up objects – not only for investment purposes, but also for the image of wealth these artistic objects conferred.

By the middle of last year, the steam had begun to go out of the buying spree, though experts stress the market in China remains hot.

As Bruce MacLaren, a Chinese art specialist with Bonhams auction house in New York, said, “Things are not going for 50 or 100 times the estimate, but they are still selling very well.”

Well enough to lure big guns, such as Christie’s, the world’s largest auction house, which netted $25 million as collectors snapped up bottles of Château Latour, a ruby necklace and a painting by Pablo Picasso at their first Mainland China auction in Shanghai last September.

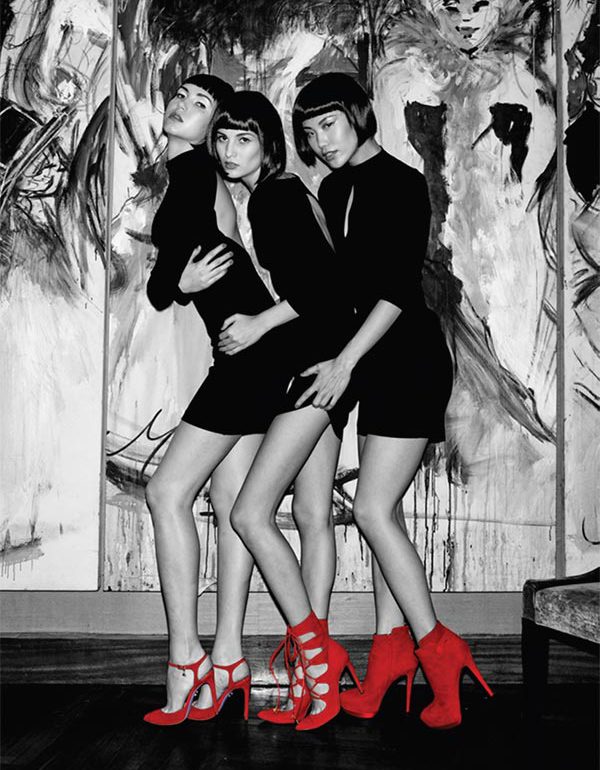

Art isn’t the only object of beauty wealthy Chinese consumers are investing in, especially for the women who have been evolving their stylish sensibilities at a rate which has come as a surprise to many international brands and fashion mavens. Even as the growth of the luxury market has slowed over the past 12 months, women’s wear and luxury accessories have continued to surge ahead comparatively strongly. Long overshadowed by luxury menswear in the Middle Kingdom, women’s wear grew at a rate of between 8 and 10 per cent last year, according to Bain & Company.

Men’s and women’s share of luxury spending in China reached equal levels in 2013, a rapid evolution from a starting point of over 90 per cent spending by men in 1995. “The mindset among global brands here is changing from men’s categories and accessories to women’s categories and fashion. Brands are preparing for this major shift,” said Bruno Lannes, a Bain partner in Greater China and lead author of the Chinese edition of the study.

Alison Yeung, the woman behind Shanghai-based luxury shoe and accessory brand, Mary Ching, has seen first-hand the evolution in taste of Chinese women with means. “There is a move away from that branded, inyour- face bling. The people coming into new money will still be at that bling level, but the wealthier China becomes, the larger the number of discerning customers who will be moving away from that kind of ultra-bling,” she said.

The next big thing in fashion for Chinese consumers, according to Yeung, will be customisation, as wealthy women want something special they can show off to their friends, who now all have Louis Vuitton bags, Burberry trench coats and well-tailored Gucci pants suits. “I absolutely believe that personalisation is something that is interesting and liked here. Chinese love that tailor-made and handcrafted element,” she said. “Recently at our events, I have been autographing by hand, each pair of shoes purchased, which has been very popular; it makes the purchase a little bit more special. Beyond the service of welcoming someone to your retail space, you have to go the extra mile to make customers feel valued.”

Service is also becoming increasingly important to winning customers in the sphere of high-end entertainment. Traditionally the domain of China’s clear spirit, Maotai, long beloved by official banqueters, the high end spirits market has taken a significant hit from President Xi Jinping’s mission to curb conspicuous consumption. According to the Hurun Report, which annually surveys Chinese High Net Worth Individuals (HNWIs) with a personal wealth over 10 million yuan, there are still expensive alcoholic gifts doing the rounds in China, with red wine rating among the most popular gifts for men priced at under RMB 20,000. Imported spirits such as whisky and cognac are also on the up.

Reminiscent of elaborate jewellery from the 1920s, the marble bar at CICADA UltraLounge is the longest in town

Beyond the official crackdown, the increasingly international focus of Chinese drinkers is another main reason for this shift in high-end alcohol consumption. It’s also the reason a couple of long-term expats in China with past success in Beijing’s F&B scene, decided now was the time to open a high-end ‘ultra lounge’ in the nation’s capital.

Catalin Ichim is one of the co-founders of CICADA UltraLounge, with its 20-foot marble bar and a focus on the very best in food and mixology. The 2,700-square-foot venue caters to a wealthy Chinese clientele looking to recreate the luxury nightlife they may have experienced on their travels to Milan or Paris.

Jeffrey, editor at Beijing-based Lifestyle Magazine and Juli of Mario Testino’s studio, regularly frequent CICADA

“There was a gap in the market where nothing similar to what is happening overseas was happening in Beijing; this is what got us started,” Ichim said.

Although Ichim says they have been somewhat insulated from the crackdown because their focus has been less on politically powerful, wealthy consumers, those that have come through the doors thus far have shown an incredibly developed sense of what they want in terms of service.

“The pattern of consumption has changed a lot from being focused on the product itself to now being more focused on the service and experience that you get,” he said.

Across the luxury spectrum, it seems, it is the experience that counts for wealthy Chinese consumers in 2014. “It’s a little bit of soul-searching, or enlightenment happening. People are looking to and discovering new things in all aspects of their life, including art, design, drinks, food and anything that would make their life richer, that would enrich their life experience,” Ichim said.

Recent Comments